How to Start Investing: A Step-by-Step Guide for Beginners

When it comes to growing wealth and saving your money from inflation, investing is the way to go. At first glance, the process of investing can seem intimidating, as it involves the use of various tools, knowledge of the market, and understanding of risks. At the same time, it is accessible even for novices if they know a few essential concepts and choose the right investment tools.

What is the best way to invest money? Keep reading to learn how to start your investment journey, what account types are available, and the most optimal investment options for beginners.

HOW TO START INVESTING

Before we discuss investment ideas for beginners, you should take the time to consider some key insights.

Determine your investment goal

Prior to diving deep into the world of investing, you need to have a clear understanding of your investment goals. Deciding what you want to save your money for (retirement, purchasing a house, funding your child’s university studies, etc.) and your timeline will determine the best investment options. For example, if you are thinking about retirement, you can choose a 401(k) or IRA account.

Assess your risk tolerance

Another step before finding the best investment for beginners is assessing your risk tolerance. To put it simply, this concept refers to how much you are willing to risk your money for the prospect of getting a high return. For example, those who have a high-risk tolerance can opt for more stocks in their portfolio, while those who take a more conservative approach can opt for a higher portion in bonds.

Consider your investing style

One of the important decisions you must make in your search for the best way to invest cash is the choice between active and passive investing. The main difference between these approaches is that active investments require a lot of effort, including searching for suitable instruments, buying them, tracking the dynamics of prices and interest rates, and resale to make a profit. Alternatively, passive investing is cheaper, requires minimal involvement, and is guaranteed to accumulate individual funds over a long period of time.

Passive investing does not require too much specific knowledge or time for analysis and provides stable income in the long term, even with minimal effort—this makes it the best option for novice investors.

For aspiring new players in the field, the best investing opportunities are a high-yield savings account, a short-term certificate of deposit, a mutual fund, an index fund, an individual stock, and a workplace retirement plan.

Choosing Your Investment Account: Top 4 Choices

After you have decided how to invest money and choose your preferred asset types, you must open an investment account to hold your cash and savings. The choice of account type depends on your savings goals, strategies, and personal investment style.

So, there are several kinds of investment accounts with different purposes and benefits. Defining the account characteristics you’ll need is one of the first things you should do when you’re about to start investing. Let’s look at some of the main account types and the scenarios when they are the best option.

- Standard brokerage account. This is the best solution for investors looking to maximize flexibility in asset choice and money withdrawal. A taxable brokerage account is generally considered the “default” option for investment in general.

- Education savings account. A natural choice for those who want to save for a child’s education or finance their own education. As the name implies, this investment account may be used for academic purposes only.

- Employer-sponsored account. The preferred solution for employees who are striving to increase their retirement savings. These employer-sponsored accounts provide excellent tax benefits that help investors save for retirement.

- Individual retirement account. This is a long-term savings account that people with earned income can use to save funds for the long-term future, complete with additional tax benefits. It is the best option for self-employed people who do not have access to workplace retirement accounts.

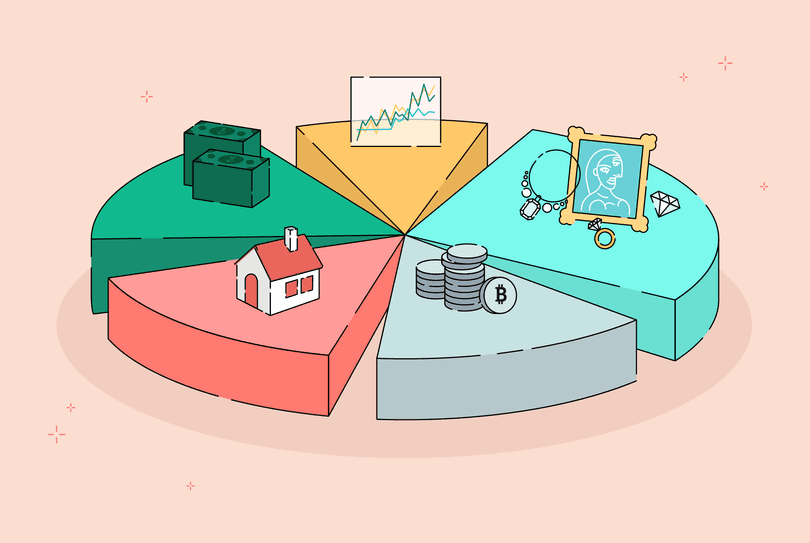

Best Investment Options for Beginners

What are the best ways to invest money if you are a newbie? Here are the main options to consider.

Certificates of deposit

One of the great ways to invest money for beginners is to go for a certificate of deposit. As an investor, you can buy a CD for a period that works for you—a few months, a year, or more. The way it works is that you will earn interest on your savings, and you usually cannot withdraw your money without a penalty during the chosen period. The advantage of this option is its security and high interest rate.

High-yield savings accounts

Another one of the accessible and simple investments for beginners is a high-yield savings account. You can easily open this type of account online through a bank and earn higher interest compared to an average savings account. This investment opportunity is particularly suitable for saving up for big purchases and setting money aside for emergencies.

Mutual funds

A good investment option for those starting their investment paths is mutual funds. With this option, you immediately invest in an entire basket that includes stock and bond varieties, so you don’t have to choose each one individually. Some of the most widely chosen options include the S&P 500, which features approximately 500 biggest US companies.

Final Thoughts

Investments allow you to receive additional income in order to, at a minimum, maintain the purchasing power of savings and protect yourself against inflation. Even beginner-level investors without special knowledge can still receive a stable income in the long term by choosing a passive approach to investing,

To become a successful investor, you should develop an investment strategy, define short-term and long-term goals, analyze your risk tolerance level, determine the amount of money to invest, find the best investing option, and diversify your portfolio to minimize risks. And remember: the sooner you start investing, the more you will earn.