The Best Ways to Invest Money for Beginners: A Complete Guide

In simple terms, investing is saving money today to benefit from it in the future. It is a rejection of immediate gratification in favor of long-term profit and increased resources, letting your money work for you.

Investing can be a great way to grow your wealth, achieve your financial goals, and protect your savings from inflation. And the better decisions you make about your asset allocation, the higher your profits are. However, it is also important to remember that all investments involve risks. It is critical to develop a planned investment horizon, determine your risk tolerance, and understand the nature of the market.

Keep reading to learn everything you need to know to start your career as a successful investor. In this article, you will find info on what a novice investor should pay attention to — investment options with great earning potential, win-win strategies and rules, as well as useful tips and tricks and top investment ideas for those who are just starting their savings journey.

So, what are the best ways to invest money, what steps should you take to earn passive income, and how do you protect yourself from investment risks?

Starting Your Investment Journey

Before you begin your investing journey, you should take the time to consider some key insights. Among the essential issues you should pay attention to are developing an investment plan that meets your short-term and long-term financial goals, analyzing your risk tolerance level, studying market cycles to determine the optimal time to enter and exit investments, choosing savings tools and finding the most profitable ways to invest money.

One of the important decisions you, as a novice investor, must make in your search for the best ways to invest cash for beginners is the choice between active and passive investing. The main difference between these approaches is that active investments require a lot of effort, including search for suitable instruments, buy them, track the dynamics of prices and interest rates, and resale in order to make a profit. Alternatively, passive investing is cheaper, requires minimal involvement, and is guaranteed to accumulate individual funds over a long period of time.

Passive investing does not require too much specific knowledge or much time for analysis and provides stable income in the long term even with minimal effort — this makes it the best option for novice investors.

High-yield savings accounts, short-term certificates of deposit, mutual funds, index funds, individual stocks, and workplace retirement plans are the best ways to invest capital for aspiring new players in the field.

Choosing Your Investment Account: Top 4 Choices

After you have decided on the best ways to invest your money and chosen your preferred asset types, you must open an investment account that will hold your cash and savings. The choice of account type depends on your savings goals, strategies, and personal investment style.

So, there are several kinds of investment accounts with different purposes and benefits. Defining the account characteristics you’ll need is one of the first things you should do when you’re about to start investing. Let’s look at some of the main account types and the scenarios when they are the best option.

- Standard brokerage account. This is the best solution for the investors looking to maximize flexibility in asset choice and money withdrawal. A taxable brokerage account is generally considered the “default” option for investment in general.

- Education savings account. A natural choice for those who want to save for a child’s education or finance their own education. As the name entails, this investment account may be used for academic purposes only.

- Employer-sponsored account. The preferred solution for employees who are striving to increase their retirement savings. These employer-sponsored accounts provide excellent tax benefits that help investors save for retirement.

- Individual retirement account. This is a long-term savings account that people with earned income can use to save funds for the long-term future, complete with additional tax benefits. It is the best option for self-employed people who do not have access to workplace retirement accounts.

Minimizing Risks With Diversified Portfolio

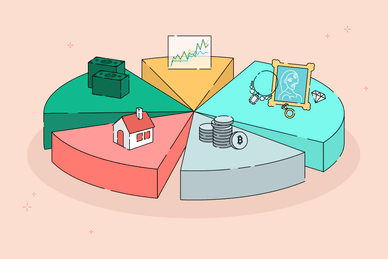

There are many ways to invest, from safe options with low returns to riskier options with higher returns. This variability allows each investor to find the best places and ways to invest money, as well as choose those options that offer different returns and correspond to the risk profile. Diversification is the process of spreading your investments across different assets and geographies to offset any potential losses. This way, if one investment avenue will prove unsuccessful, the investor will be free to relocate resources without losing a large share of their profits.

Including assets with different profit-generating and growth potentials in your portfolio helps to balance it and allocate the risk — simply put, if one type of asset does not grow, others may generate profit. Diversification is critical to reducing risk and increasing returns.

Final Thoughts

Investments allow you to receive additional income in order to, at a minimum, maintain the purchasing power of savings and protect yourself against inflation. Even beginner-level investors without special knowledge can still receive a stable income in the long term by choosing a passive approach to investing,

To become a successful investor, you should develop an investment strategy, define short-term and long-term goals, analyze your risk tolerance level, determine the amount of money to invest, find the best ways to invest cash, and diversify your portfolio to minimize risks. And remember: the sooner you start investing, the more you will earn.

FAQ

What are the benefits of investing money?

Investing allows you not only to save your funds but also to increase them. By sticking to the tried and best ways to invest money you can protect your savings from inflation, earn passive income, achieve your short-term and long-term goals, and increase your wealth relatively easily. In general, investing stands for making your money work for you all the time.

How much money do I need to start investing?

There are a huge number of investment options, and among them, you can find ways to start investing with virtually no start-up capital. In fact, you can start investing even with a budget of $1. One way or another, the amount of money to start investing depends on your financial capabilities and savings goals.

What are the best investment options for beginners?

The best ways to invest capital for beginners include high-yield savings accounts, exchange-traded funds, short-term certificates of deposit, mutual funds, index funds, individual stocks, workplace retirement plans, and other investment options. The best solution for novice investors is to take a passive approach to investing rather than an active one.