Bitcoin Mining: A Detailed Guide

Contents

What is crypto mining? Even though cryptocurrencies become more prevalent every day, the concept of Bitcoin mining is still confusing for many people. To put it simply, a Bitcoin miner uses a powerful computer to solve mathematical puzzles to prove a transaction and receives rewards for the results of this work. The process of Bitcoin mining is designed to secure transactions and maintain the integrity of the blockchain, a technology behind the whole concept of cryptocurrencies.

If you want to learn more about what mining Bitcoin involves, which hardware and software is used, and what difficulties aspiring miners can encounter, this Bitcoin mining guide has all the information you need.

What Is Bitcoin Mining?

Bitcoin, like other cryptocurrencies, remains one of the key payment industry trends today. Numerous investors who are new to the world of digital currencies wonder — what is cryptocurrency mining, and why do you need to mine? Bitcoin mining is the process of validating information in blockchain blocks by generating a solution to a mathematical equation that matches certain criteria.

The role of a miner in the network is to make sure that all transactions involving Bitcoin are secure and validated. As it is a digital currency, there is always a risk of double-spending, so miners are there to prevent this from happening. With the help of miners, Bitcoin can continue to be a reliable decentralized currency.

The systems that participate in mining compete with each other, so those miners who provide a solution to the problem first receive all the rewards.

How Does Bitcoin Mining Work?

One of the most commonly asked questions related to cryptocurrency — how does mining Bitcoin work? It is a complex process that involves several steps, so it’s important to be familiar with all the concepts associated with it.

Hash creation

The process of mining begins when an individual performs a Bitcoin transaction. When this happens, a block containing a transaction group is created, which serves as a container for recording transaction data. Once the block is assembled, miners enter additional data, including a timestamp and a reference to the previous block's hash, to create a unique block header. The block header, along with a random number (nonce), is then input into the SHA-256 hashing algorithm the network uses to perform initial security checks. This process generates a cryptographic hash. It’s a 64-digit alphanumeric string that uniquely represents the block's contents. This is how miners become involved in the process.

Finding target hash

After the hash is created, Bitcoin miners use their software and hardware to start generating various hashes of their own. The goal of this process is to generate the target hash, which is the value matching a certain predetermined condition set by the network and meant to ensure the mining process's competitiveness and security.

Because of the hash encryption, the process is difficult and requires significant computing power. Miners repeatedly modify the nonce in the block header and recompute the hash until they find a value below the target hash. This process involves trial and error, as there is no way to predict the output of the hash function.

Receiving rewards

For a miner, the purpose of getting involved in the process is to get a reward. The first person to generate the target opens a new block. This individual will receive the fees and a reward (currently 6.25 BTC), as they will be the ones to add the block to their copy of the blockchain. After the block is filled with the right information, it will be encrypted and then mined.

One thing to note about rewards is that they are affected by a halving mechanism. To create scarcity, a halving of rewards happens automatically after a certain number of blocks have been mined. This occurred last time in May 2020, and it is predicted that the next halving will take place around April 2024.

What is proof-of-work?

Mining requires a significant amount of computational power and energy to reach a target hash, necessitating security measures to prevent fraud. Blockchain security and decentralization of mining are achieved via proof-of-work. This concept can be defined as a consensus mechanism in which miners receive rewards for adding difficulty and computation power to the Bitcoin network.

The goal behind the proof-of-work mechanism is to ensure the maximum integrity and security of transactions. In Bitcoin mining, proof-of-work works similarly to purchasing lottery tickets, but people buy equipment for mining instead of tickets and participate by plugging them in. While all tickets are equal in a lottery, it is only natural that the more of those you have, the higher the chances of getting a reward. The same principle applies to mining.

Navigating Hardware, Pools, and Software

How do you mine cryptocurrency, and what do you need to begin? In this part of the guide, we’ll discuss the types of Bitcoin mining software hardware used and the concept of mining pools.

Mining Hardware

There are numerous mining hardware options available out there, but most of them can be divided into three main categories: GPUs, CPUs, and ASICs.

CPU mining

CPUs, which stand for central processing units, are involved in all blockchain calculations. Computers used for mining all have such units which perform the required mathematical calculations.

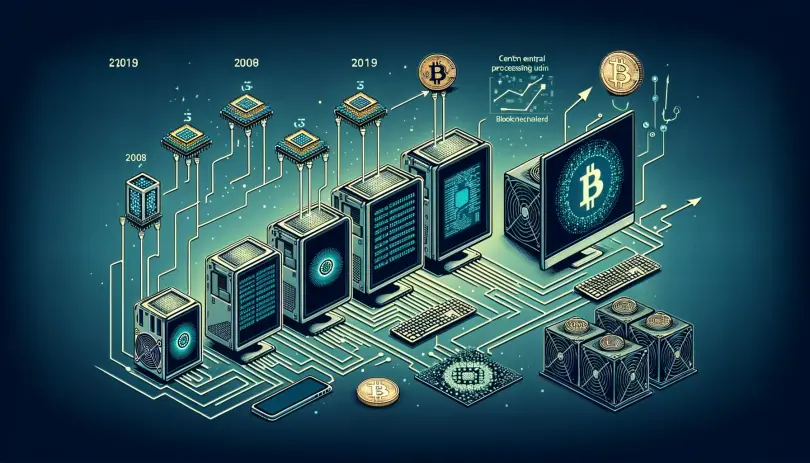

The evolution of mining equipment began with the use of a personal computer. Satoshi Nakamoto, the developer of Bitcoin, started mining in 2009 using a basic computer. However, this approach was only viable because there was no competition at that point.

Over the years, computers that can be used for cryptocurrencies have become more powerful and refined, as more computational energy is now required for a decent chance to win the mining “lottery”. CPUs are often used by beginners who are still learning and also cannot invest a lot of money from the start.

GPU mining

The next step in the evolution of Bitcoin mining hardware involved GPUs. The term stands for graphics processing unit, which is a modern, high-quality graphics card efficient enough to solve equations associated with cryptocurrencies.

GPUs started to be used for mining crypto in 2010, and they are more powerful compared to CPUs. When miners started using GPUs, it was calculated that these systems were approximately six times more efficient in earning block rewards compared to the previously implemented CPUs. At the same time, an average device of this type is only two times more expensive compared to a CPU.

ASIC mining

The third innovation that changed the world of Bitcoin mining is ASICs, which appeared in 2013. ASIC stands for application-specific integrated circuit, and it is the type of hardware that was created specifically for mining. They are extremely effective at solving mathematical equations and offer higher speeds compared to standard computers.

As opposed to GPUs and CPUs, the advantage of this system is that it uses less power while the hash rate you get is significantly higher. As a result, more equations are solved, and ASIC miners receive higher rewards more frequently.

Such profitability comes with one downside — the initial cost of hardware. This type of hardware is more expensive compared to GPU-based systems or powerful computers. At the same time, you will get back the money you invested a lot faster because of the increased mining efficiency.

Cloud mining as an alternative option

Those who don’t want to invest in hardware can instead rent equipment or computing power from centers designed specifically for this purpose. When you choose this approach, you don’t have to buy hardware, ensure the best Internet speed, or stable electricity. The system works similarly to a subscription plan, where you pay fees to rent some power or an entire rig.

Mining Pools

As mining becomes more time-consuming and requires more power, the cryptocurrency community has found a solution — mining pools. A mining pool is a group of miners who connect their available devices via a network to increase their chances of mining Bitcoin and getting rewards.

It is not a secret that it may take a solo miner years to start receiving decent profit from mining. Over these years, they have to invest in equipment, run it, cool it down, and otherwise maintain it to continue performing Bitcoin-related calculations.

The main and biggest advantage of being a part of a mining pool is that you can progress faster, especially if you cannot spend a ton of money on state-of-the-art equipment. A mining pool offers a more affordable entry point to cryptocurrency mining, and you are a lot more likely to receive rewards this way.

As for the disadvantages, there are also several things to keep in mind:

- As the method’s name implies, you will receive only a portion of a reward, which can be lower than what larger contributors to the pool are earning.

- There is always a risk of fraud, hidden generated blocks, and stumbling upon fake mining pools. You have to be attentive and know how to find an authentic pool to join.

- Some mining pools may require high fees to join, so you must choose a reasonable option.

How do you mine Bitcoin in a mining pool? To join a mining pool, you need to first find one by looking up reviews and the history of pools. Then, you need to input its address into your software, connect your wallet to it, and configure your hardware to the chosen pool.

Choose one of the top crypto wallets to suit your needs and feel comfortable in the world of cryptocurrencies. Using the example of Coinbase wallet review, where we described in detail all the nuances and aspects of this wallet, you can understand what exactly you should pay attention to when choosing.

Mining Software

To learn how to mine Bitcoin (BTC), you also need to know about specific software. The hardware performs complex calculations, while the Bitcoin mining software is used as the center for interacting with mining-related operations and managing them. Picking the right software is essential, as you will need customization options, real-time monitoring, pool management, and other specialized features.

The choice ultimately depends on your preferences and available equipment, but some of the popular options include:

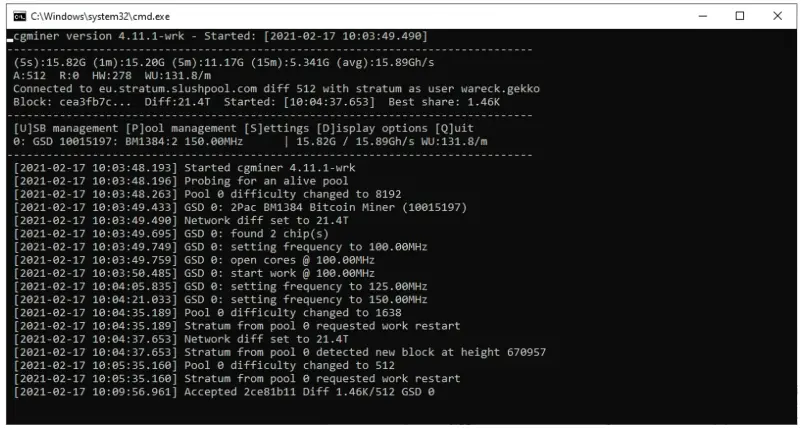

CGMiner

If you are looking for a highly versatile solution, consider CGMiner. It has been around for a long time and works with various hardware, such as GPU, ASIC, and FPGA. Its advantages include extensive overclocking opportunities, advanced monitoring, and active development. While it is a customizable and reliable option, its interface may be confusing for beginners.

If you don't have the capabilities to engage in mining, we recommend paying attention to crypto investment for beginners, that don't require powerful hardware.

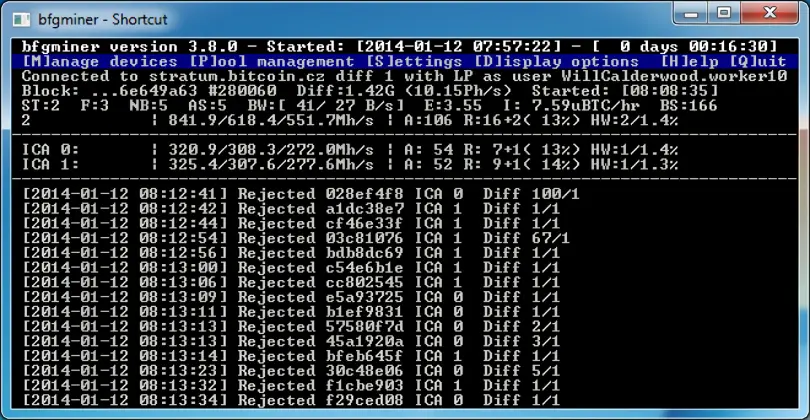

BFGMiner

Another popular software option is BFGMiner, which is a modular-type software excellent for individuals who like to have more control over the mining process. The software can be used with different hardware configurations and provides dynamic monitoring. As you’ll need a manual setup to get the most out of this option, it is mainly used by more experienced miners.

Learn the main 5 types of cryptocurrency for an easier understanding of the details of other coins.

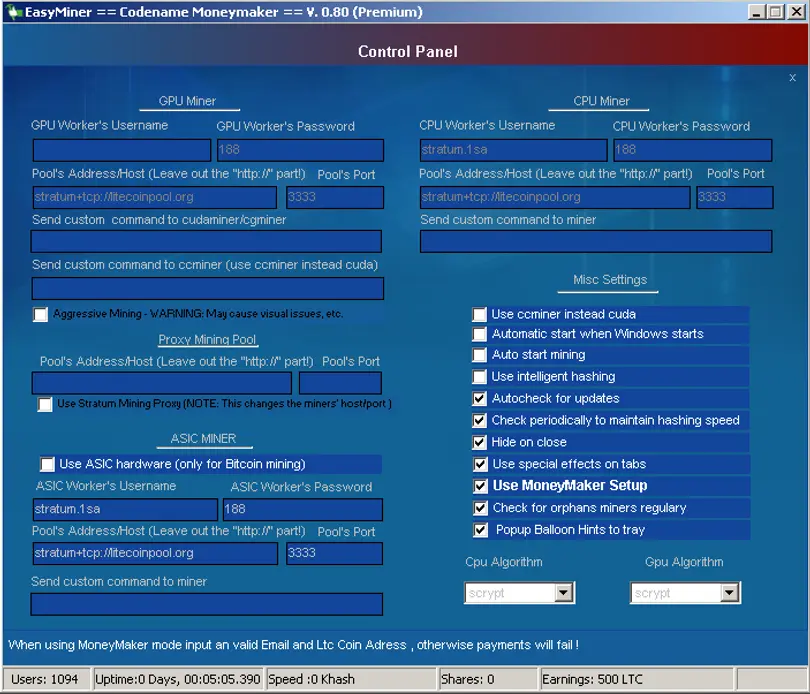

EasyMiner

If you are a complete beginner and require the most straightforward Bitcoin mining software possible, EasyMiner is a great variant to consider. This GUI-based solution for mining is known for its simplicity, so it is ideal for people who are just entering the crypto world. It is easy to navigate, offers a visual presentation of your mining process, and is one of the most hassle-free options there is.

Mining Crypto Difficulty

Mining difficulty is an integral part of the process, referring to how much work has to be invested to generate the target hash. At the moment, the difficulty of mining Bitcoin increases every 2.016 blocks, which is the number achieved by miners in a fortnight on average.

What affects mining difficulty?

Two main things impact mining difficulty. First, the difficulty level changes depending on how efficiently miners managed to work in the previous period. Second, if more miners join Bitcoin’s network, more computing power is needed to achieve the results. The more competition there is, the more challenging it becomes for miners to solve the equation.

As of January 2024, the difficulty level for Bitcoin mining is 73.2 trillion. This means that the chance that a computer finds a hash below the target one in a single attempt is 1 in 73.2 trillion. Because it is obvious that difficulty is constantly increasing, it is only natural that so many people choose to join their forces in mining and enter mining pools to increase their chances of mining a Bitcoin.

BITCOIN MINING ISSUES TO CONSIDER

BTC mining stands on guard for the integrity and security of transactions on the Bitcoin network. However, mining comes with its fair share of issues that should be monitored and addressed to ensure the network’s long-term viability and resilience.

Speed

The increasing number of miners hinging on the network and growing competition lead to longer intervals between the creation of new blocks. A slower speed can affect transaction confirmation times and overall network efficiency.

Scalability

While the transaction volume and miners’ workload bump up, the scalability of BTC’s blockchain is limited by its block size and block interval, which are currently 1MB and 10 minutes. This can result in congestion during periods of high transaction flow, leading to delays and higher fees.

Energy Use

Mining hardware consumes a lot of electricity to operate. Additionally, the growing computational power required for mining entails a corresponding rise in energy consumption. All of this pushes miners to seek energy-wise solutions to optimize consumption and reduce the environmental impact.

Centralization

As mining becomes more competitive and resource-intensive, it favors large operations with access to cheap electricity and specialized equipment. At the same time, the concentration of mining power in the hands of a few entities can lead to potential manipulation and control over blockchain, raising questions about the BTC network's security

Regulatory Outlook

Bitcoin mining is certainly a global phenomenon, and there are a lot of things that influence the process, which can be different depending on where you live. So, what is mining Bitcoin like in terms of different regulatory developments?

Current Regulatory Environment

Cryptocurrencies, including Bitcoin, are regulated in different ways depending on which part of the world you live in. In some regions, they are fairly well-regulated, while others completely ban their use. For this reason, cryptocurrency investment can be quite risky as there are no global laws that would make the process of mining and using cryptocurrency more universal.

Global Variances

How is Bitcoin mined from one country to another? As mentioned, there is a high level of global variances when it comes to cryptocurrency. If we take Bitcoin, numerous developed countries, including the UK, Canada, and the US, allow this cryptocurrency to be used. At the same time, Bitcoin is currently illegal in some countries, such as China and Saudi Arabia.

Compliance Measures

With proper regulations in place on a global scale, the issue of compliance can be solved relatively easily. Once that happens, there will be proper financial inclusion and the possibility of performing international transactions routinely. This has the potential to offer benefits to both businesses and individual cryptocurrency owners internationally.

Potential Future Regulations

In 2024, several countries are expected to undergo changes when it comes to cryptocurrency-related regulations. For instance, in the United States, there is supposed to be more clarity regarding investor protection measures and taxation policy. At the same time, the European Parliament adopted a regulation referred to as MiCA (Markets in Crypto Assets), which is supposed to enter into force later in 2024. Japan is heavily focused on consumer protection, so we can expect more developments in this field in the next year.

Collaboration and Advocacy

Collaboration between various financial institutions and cryptocurrencies can be one of the ways to open up conversations about regulatory improvements. When a partnership happens between an innovative digital currency and a traditional institution, such as a bank, there is a higher chance of cryptocurrencies becoming a part of daily life.

Global Cooperation

Global cooperation seems to be one of the keys that will minimize the risks and threats associated with the use of cryptocurrencies. It is important to get organizations together to discuss the development of common practices in trading and stop the current regulatory arbitrage. Some of the organizations focused on the promotion of better regulations include IOSCO and FATF.

Impact on Innovation

There is no doubt that Bitcoin continues to have a significant impact on innovation. When it comes to the influence of cryptocurrencies on the tech industry, it promotes innovation in the sphere of decentralized finance and leads to the creation of blockchain development companies.

Investor Confidence

It is obvious that when people want to invest their money into cryptocurrencies, they want to feel more confident about where they place their funds and have a higher level of protection. The goal of regulators, in this case, is to ensure that investors are protected from potential money laundering and fraud. Also, having the right regulations may reduce the current volatility of the cryptocurrency market.

Recommendations for Miners

Now that you know what mining cryptocurrency is, another question is, what should you do with this information? In terms of regulations, it is important to be on the lookout for any changes that appear. There are plenty of resources online where you can read news about changes in the world of cryptocurrencies. Another recommendation is to mine and use Bitcoin only in countries where this practice is legal.

Final Thought

Despite the challenges and the uncertain chances of mining Bitcoin, many individuals and organizations continue to engage in mining. So, once you’ve got an idea of how to start Bitcoin mining, it is important to mind the risks and decide what approach will be best suited for you.

The process begins with learning Bitcoin mining basics and finding the equipment you can afford. If you cannot invest in top-notch devices, it can be a good idea to combine efforts with others in mining pools to gain more opportunities to earn rewards.

When it comes to regulation, it all depends on the country you live in and whether cryptocurrencies are considered legal. The regulation of cryptocurrency on a global scale still has a long way to go, but the much-needed changes are already taking place. Also, there is an increasing need for developing green mining solutions, as the process is energy-consuming and thus not sustainable in the long run in its current format.

FAQ

What hardware is commonly used for Bitcoin mining?

Beginners mostly rely on CPUs and GPUs for mining BTC, while people who are more serious about mining opt for ASICs. Equipment varies in its power consumption, prices, hash rates, and more. Some of the leading hardware options include Antminer S19 Pro, Canaan Avalon Made A1366, Ebang Ebit E11++, and MicroBT Whatsminer M50S.

What role do mining pools play in the mining process?

Mining pools increase the chances of miners involved in them receiving rewards. This approach to crypto mining is particularly common nowadays because it can be difficult to receive rewards in solo mining if you don’t use state-of-the-art hardware.

What challenges do Bitcoin miners face, and what does the future hold for mining?ng?

One of the first challenges that arises when someone decides to mine Bitcoin is the cost of hardware, which can be expensive. The next thing to keep in mind is that mining becomes more difficult each year, and it takes more effort to get rewards. And, of course, there is regulatory uncertainty, although there seems to be progress in this field lately.