Braintree Payment Review: Features, Pricing, and Alternatives

In the realm of online payments, the choice of a payment processor can make or break your business. Among an ocean of options currently available on the market, Braintree Payments immediately pops up as a comprehensive solution with a suite of features tailored to meet the needs of any modern e-commerce.

In this Braintree Payments review, we delve into the core aspects of this system and see how it stacks up against its close competitors.

Braintree at a Glance: Main Features

Subsided to PayPal, Braintree Payment Gateway is a robust and versatile payment platform capable of integration with various applications and websites. As such, it can serve as a one-stop shop for businesses of all sizes that need to accept and manage online payments.

The payment processing system comes with a rich feature set:

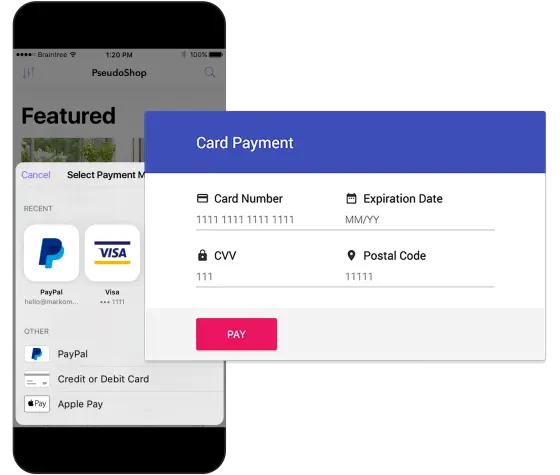

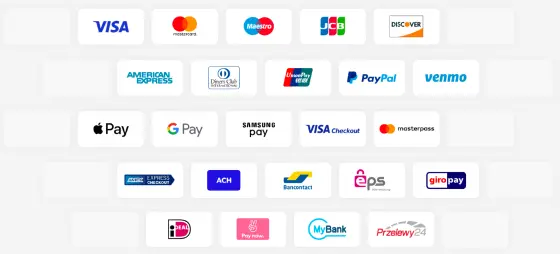

- Diverse payment methods: Similar to more popular processors like Stripe, Braintree supports various payment methods, including major credit and debit cards (Visa, Mastercard, American Express), digital wallets (PayPal, Apple Pay, Google Pay), and local payment options, all in a single integration.

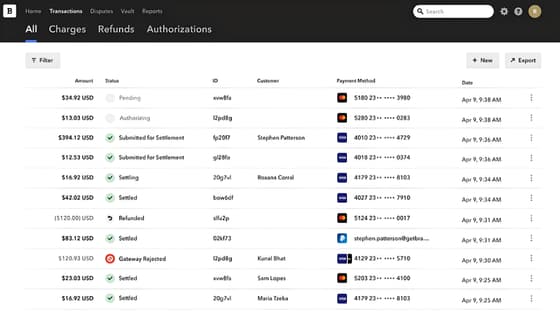

- Advanced security: The platform employs robust protection tools to safeguard sensitive card data and reduce the risk of data breaches. Meanwhile, its complex fraud protection feature helps merchants detect and prevent suspicious transactions and scams.

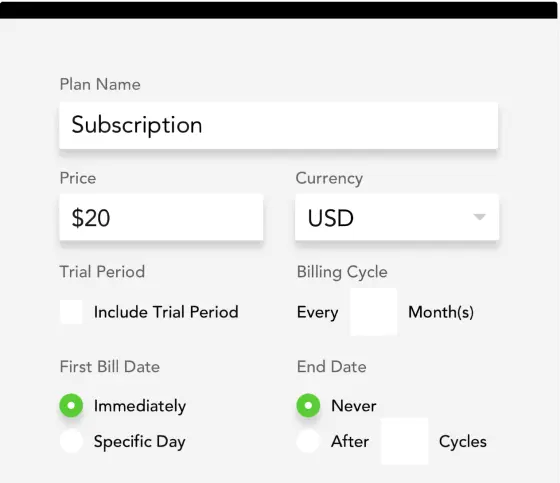

- Recurring billing: With its recurring billing feature, a Braintree account will come in handy for subscription-based businesses. Merchants can set up recurring payment schedules, manage subscriptions, and handle changes or cancellations without much effort. This is especially beneficial for streaming platforms or SaaS providers.

- Global reach with multi-currency support: The Braintree international payments system accepts over 130 currencies, allowing merchants to process more payments, facilitate transactions for global customers, and reduce currency conversion complexities.

- Developer-friendly API: The system’s API is renowned for its ease of integration and developer-friendly documentation. This API-first approach ensures smooth integration with various platforms and even custom solutions. With this feature, Braintree processing platform becomes an ideal choice for businesses seeking tailored payment solutions.

While less popular than industry leaders like Stripe and Square, Braintree is a feature-rich service with significant benefits for both customer and provider.

Braintree Payments Pricing

Braintree pricing model is also transparent and straightforward with a flat rate approach. The standard transaction fee is typically around 2.59% + $0.49 per transaction for online and mobile payments in the United States.

There are no setup or monthly fees for standard payment methods, making the Braintree payment solution a cost-effective option for small businesses and start-ups.

While this vendor relies on a flat-rate system, it still offers specific discounts for bigger businesses. If you use Braintree as an individual merchant or a company and process over $80.000 a month, you can expect lower per-transaction fees.

Pricing Aspect | Details |

|---|---|

Standard transaction fee for debit and credit cards and wallets | 2.59% + $0.49 |

Transactions in non-US currencies | Standard fee +1% |

Cards issued outside the US | Standard fee +1% |

Chargeback | $15 flat fee |

Venmo | 3.49% + $0.49 |

ACH direct debit | 0.75%, with maximum capped at $5 |

In terms of pricing, Braintree fees are slightly lower than those of Stripe at 2.9% + $0.30 per transaction. At the same time, Stripe offers more customization in fees for specific services, allowing businesses to better tailor their pricing structure.

At 2.6% + $0.10, Square is a bit more affordable for online payments than Braintree. Yet, Square may charge additional fees for specific services or transactions involving international credit cards.

Braintree Alternatives

Braintree stands out as a leading payment processing platform along with Stripe and Square. However, each of these systems has its unique features and caters to specific business needs. Braintree payment solution excels in its e-commerce versatility and robust security measures. Stripe, with its developer-centric approach, offers extensive customization. Meanwhile, Square focuses on user-friendly point-of-sale solutions.

Aspect | Braintree | Stripe | Square |

|---|---|---|---|

Payment methods | All types of online payments, including wallets | Online and in-person point-of-sale payments | Online and point-of-sale payments with sophisticated POS solutions |

API & Integration | Developer-friendly with robust API | Highly flexible API and documentation | User-friendly with easy setup |

Standard Fees | 2.59% + $0.49 | 2.9% + $0.30 | 2.6% + $0.10 |

Features | Multi-currency support Recurring billing and subscription management Strong integration capabilities Access to the PayPal ecosystem Availability in 45 countries Available for payments via web or mobile apps only | Extensive payment support Customizable checkout experiences Strong integration capabilities Invoicing, financing, and coupon collection Subscription management | Diverse payment options Top-notch POS payment solutions Inventory management and analytics Easy and straightforward setup Ideal choice for brick-and-mortar businesses |

As you can see, the choice largely depends on the nature of your business operations, preferred API integrations, pricing structures, and whether your businesses require unique payment features.

Final Thoughts

Braintree surpasses the competition in security, versatility, and integration capabilities, as well as its access to PayPal functionality. The provider positions itself favorably in a highly competitive landscape and is a perfect match for e-commerce businesses with well-defined growth trajectories.