Cash App Fees: What You Need to Know

Former Square Cash, Cash App is a popular peer-to-peer payment platform, allowing users to send and receive money effortlessly. While it offers a user-friendly experience, it's crucial to understand the fees you might incur when using the service.

In this guide, we’ll review Cash App fees, providing comprehensive information to help you make informed decisions and take full advantage of this financial services platform's features while minimizing any unexpected costs.

How Much Are Cash App Fees: Detailed Structure

Similar to other P2P services, Cash App is free per se. It means that downloading and using the app will cost you nothing, while you’ll enjoy on-the-go convenience and easy money transfer between bank accounts.

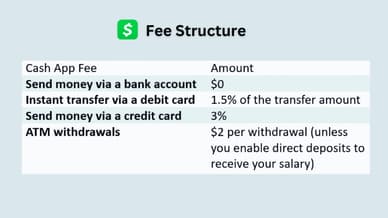

The system ensures standard transactions for free, and you’ll incur no added Cash App fees for sending money to your family members or friends from your Cash App account tied to your debit card or a bank account. However, by supporting transfers with your credit card, you’ll incur a 3% fee.

Does Cash App have fees for receiving money? Funds transferred via Cash App are automatically credited to your Cash App account. You can keep it there for further payments or transfer it to your related bank account. Standard deposits are also free. Yet, be ready to wait for 1–3 days before the money arrives in your account. Instant deposits come at a cost and entail a Cash App transfer fee ranging from 0.5% to 1.75%.

Does Cash App have fees for international transfers? You can send money internationally between two Cash App accounts, with a fee for currency conversion applied to such transactions. Typically, it’s around 1% of the total transaction amount.

Other fees for Cash App transactions include:

- Business transactions: Cash App offers a service for merchants to accept payments from customers at a 2.75% fee, which is automatically deducted from each transfer. This feature is especially useful for small businesses and individuals conducting business activities;

- Bitcoin transactions: Buying and selling Bitcoin through Cash App may involve fees based on market conditions. These fees are dynamic and can fluctuate. Usually, you’ll be charged from 2% to 3%;

- ATM Withdrawals: Cash App applies a $2.50 fee to each withdrawal, not to mention an ATM fee beyond Cash App’s control that will be charged by ATM owners.

Tips to Avoid Cash App Fees

Cash App offers a convenient platform for seamless money transfers, but as you already understand, it makes money by entailing certain charges. Therefore, we've gathered a few tips and strategies to help you minimize or even eliminate paying added fees when using Cash App:

- When you fund transactions directly from your linked bank account or debit card, Cash App typically does not impose any fees. This method allows you to send and receive money without incurring additional costs. So, refrain from using credit cards for Cash App payments since they entail a pretty high fee of 3%;

- Opt for standard transfers when time permits to avoid the instant transfer fee. When you need immediate access to funds, such as in emergencies or time-sensitive situations, the convenience of cashing out your balance in an instant may outweigh the fee, though;

- You can avoid ATM charges when withdrawing cash by setting up a direct deposit limit of $300. If you match that monthly limit, you’ll be entitled to withdraw funds for free with Cash App. Yet, the ATM owner fee will still be applied, if any.

- If you're using Cash App for business purposes, remember that a fee of 2.75% is applied to each transaction. At the same time, for smaller business transactions, the ease of use and accessibility of Cash App may justify the fee.

By following these tips, you can make the most of Cash App's services while managing fees effectively.

Final Thoughts

What are the fees for Cash App? While free for the most common transactions, Cash App does have charges when you decide to go above simple things. However, forewarned is forearmed. Knowing the charge rates, you’ll be able to use the system wisely and reap the best of its benefits.

FAQ

What is Cash App, and how does it work?

Cash App is a mobile payment platform that allows users to send, receive, and manage money through a smartphone application. Its user-friendly design and ease of use make it a popular choice for individuals, businesses, and even independent contractors. You just need to download the app, set up an account, link it to your bank account or payment card, and start sending or receiving money.

Is there a fee for sending money through the Cash App?

Basically, there are no Cash App fees for sending money if you stick to standard transfers that are processed within 1-3 business days. For instant payments, though, you’ll have to pay fees ranging between 0.5%-1.75%. Transfers supported by credit cards will also cost you 3% per transaction.

What is the fee for using a cash card?

There are no Cash App fees for ordering and using a cash card to make offline and online purchases. However, ATM cash withdrawals will incur a $2.50 fee per transaction.