Helcim vs. Stripe: Which is Better?

Contents

Finding the right payment processor for your business is essential, as it directly impacts the security of your transactions, convenience for your customers, and how much of your income goes towards fees. Some of the most popular payment tools include Helcim and Stripe — but which one will be better for you or your business?

In this article, we’ll focus on comparing Helcim vs. Stripe in terms of pricing models, fees, product offerings, and features. In this way, you will be able to decide whether one of these solutions is the right fit for your needs.

Helcim and Stripe Comparison: Rates and Pricing Models

The first major difference we should talk about in the context of Helcim and Stripe is their pricing models. Each comes with its own set of advantages and drawbacks:

Helcim’s Tiered Interchange-Plus Pricing Model

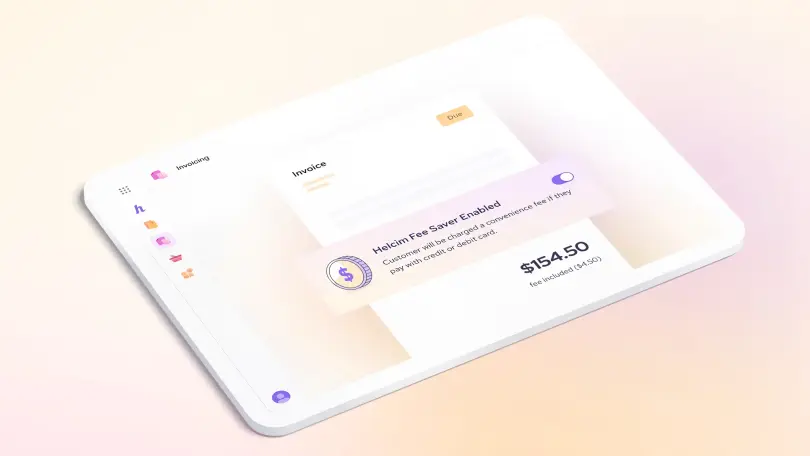

So, what is the difference between Stripe and Helcim? Helcim relies on the use of an interchange-plus pricing model, which is known for its high level of transparency. You don't need to track multiple hidden fees — instead, users just pay the fee set by their card network (like Visa or Mastercard), plus a small extra markup from the payment processor. Another benefit of Helcim is its tiered pricing model, which offers volume-based discounts — a huge plus for large businesses handling a high number of transactions.

On the downside, this model can be more difficult to calculate, and it might not be the most cost-effective option for small businesses or startups compared to a simple flat rate.

Stripe’s Flat-Rate Pricing Model

As opposed to Helcim, Stripe uses a flat-rate pricing model. With this model, you get the most straightforward approach to payment processing, as every transaction has a fixed processing cost, regardless of card type or network.

The advantage of flat-rate pricing is its simplicity, and it’s ideal for businesses that don’t qualify for dedicated merchant accounts. However, it comes with higher overall processing fees, especially on large transactions. With flat-rate pricing, a merchant doesn’t break down the card types being processed. In this way, merchants miss out on potential savings from lower-cost debit cards.

Let’s now take a closer look at the processing rates of both platforms across different transaction types:

| Helcim | Stripe |

|---|---|---|

Monthly Fees | $0 | $0 |

Online Transaction Fees | Interchange + 0.15%–0.5% + $0.15–0.25 | 2.9% + $0.30 |

In-Person Transaction Fees | Interchange + 0.15%–0.4% + $0.06–0.08 | 2.7% + $0.05 |

Keyed-in Transaction Fees | Interchange + 0.15%–0.5% + $0.15–0.25 | 3.4% + $0.30 |

What Are the Products Offered by Helcim and Stripe?

Numerous businesses also need hardware to process in-person payments, and both Helcim and Strip offer suitable equipment.

Helcim Card Reader

Helcim Card Reader costs $99 and includes all the basic features you need for in-person payment processing. It is small and lightweight, yet it can still function as a countertop terminal.

This card reader supports contactless payments and is NFC-enabled. It can be used to accept the majority of card brands and even provides customer tracking features. You can also email receipts with this solution.

Helcim Smart Terminal

Another product to mention is Helcim Smart Terminal, which costs $329. It is an excellent full-featured, all-in-one solution. It comes with pre-installed POS software and a sleek design. With the help of this terminal, you can conveniently accept all payment types, including store credit cards and cash. You can also use it to accept and create invoices. While it’s a great option for mid-size or larger businesses, it may not be the most cost-effective solution for smaller operations.

Stripe Reader M2

The most affordable card reader offered by Stripe costs just $59. It is a secure and reliable battery-powered equipment for businesses. It supports contactless, EMV chip, and swipe payments. With this solution, you also get proper end-to-end encryption. One thing to note is that Stripe’s hardware must be configured to work with the Stripe Terminal platform or your POS system.

Stripe BBPOS WisePOS E Reader

Another equipment option from Stripe is the BBPOS WisePOS E reader. This equipment is more advanced compared to Stripe Reader M2 and costs $249. It is a larger POS terminal with a touchscreen that can be easily used as a countertop solution. This reader accepts contactless, EMV chip, and swipe payments. It is a highly customizable terminal, but it requires programming and technical expertise to set it up correctly.

Helcim and Stripe Features

Choosing the right payment processor is not only about comparing the rates and products offered by the platforms. It is also about the set of features that are available. After all, these features significantly impact your daily operations and growth potential. Let’s take a look at what Helcim offers and how it compares to Stripe.

Category | Helcim | Stripe |

|---|---|---|

Merchant Account | Dedicated (more stable, stricter approval) | Aggregated (faster setup, potential freezes) |

Ease of Use | User-friendly, ready “out-of-the-box” solution (POS app, website builder) | Good usability, may require technical knowledge or developer assistance for setup and customization |

Customization | Limited capabilities | High level of customization through APIs and SDKs |

Integrations | Limited pre-built integrations | Extensive library of pre-built integrations |

Online Payments | Built-in online store builder and payment page | Flexible payment page creation, requires integration or coding for full store functionality |

Offline Payments | Proprietary POS app included, hardware works out-of-the-box | Requires integration with POS systems or Stripe Terminal API, hardware needs setup |

Fraud Protection | Helcim Fraud Defender (CVV, AVS, IPV) included | Stripe Radar (CVV, AVS, IPV) included |

Chargebacks | $15 fee (refundable if dispute is won), dispute management tool included | $15 fee (refundable if you win), optional chargeback protection (+0.40% per transaction) |

Payout Speed | Next-business-day deposits for all credit and debit transactions at no extra cost | ~2 business days, instant payout available for 1% fee |

Customer Support | Phone & email during business hours + knowledge base | 24/7 support (email, phone, chat), extensive documentation, premium support offered |

Global Reach | Available in Canada and the USA | Supports 135+ currencies and 46 countries |

Buy Now, Pay Later (BNPL) | Not available | Available through Affirm, Afterpay, Klarna, etc. |

So, who outperforms whom when it comes to functionality, Stripe vs. Helcim? The decision is yours to make. Both have their strengths, so the choice depends on what matters most to your business. If you’re looking for a quick, user-friendly setup with built-in tools, Helcim is a great choice. On the other hand, if you need more advanced features, deeper integrations, and have technical resources available, then Stripe’s arsenal might be a better fit.

Conclusion

When we compare Helcim vs. Stripe, it is clear that both are excellent services used to process payments by companies of different sizes.

Stripe undoubtedly shines in flexibility and customization of advanced solutions that will work best for small businesses with developers who can get the most out of its features. In this sense, Helcim is easier for those without extensive software knowledge. It has a straightforward POS platform and offers pre-built checkout, so you can start accepting payments right away.

Another crucial factor you should consider is the difference in pricing models. While Stripe’s flat-rate model seems more straightforward at first glance, the interchange-plus model of Helcim can help save money, especially for businesses processing larger volumes. Ultimately, the best choice depends on your business goals, technical capacity, and how much you want to save — or simplify.