How to Send Money on Cash App

Right now, sending money using peer-to-peer payment apps is easier than ever. One of the leading services for this purpose, Cash App, is known for its convenience, reliability, and unique set of features. All you need to quickly send money or pay for any expense is your smartphone and the app.

If you want to know how to transfer money using Cash App, this guide will answer your questions.

How to Send Money on Cash App

With its notably quick and secure fund transfer, Cash App has become a widely popular method of sending payments across the US. Over 45 billion active users throughout the states in 2023 can attest to the flexibility and convenience of the service. Here is how you too can use Cash App to send money to your relatives, friends, partners, or anyone located in the United States.

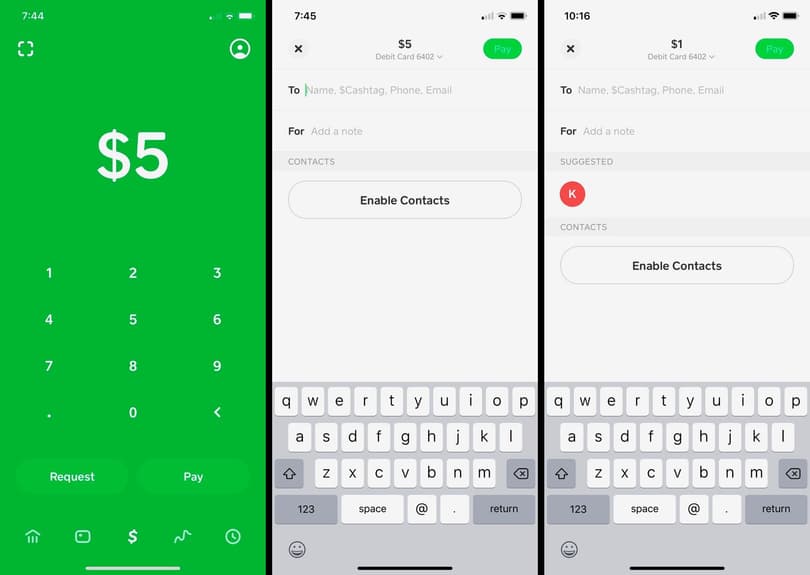

- Launch an app on your smartphone or tablet and log in by entering your credentials if it’s your first-time access.

- Enter the amount you want to send in dollars. Use the “To:” field in the center of the screen. Make sure you’ve typed in the right amount before confirming.

- Choose the recipient by entering their email address or a phone number linked to their Cash App account. Those who have linked their debit card when registering with Cash App can use the so-called $Cashtags for payments, which functions as a unique username. Before confirming, double-check that the recipient's information is correct.

- Add a note (optionally) to specify the purpose of the payment, adding a personal touch to the transaction. The space for notes is located just below the amount field.

- Confirm payment by tapping the “Pay” button. Don’t forget to check all the entered info beforehand, since this action is irreversible.

For any transactions, a Cash App transfer fee is charged depending on the size and type of transaction.

Cash App Sending Limits

When learning how to send funds using Cash App, you need to keep in mind the sending limits the system imposes on instant transfers. Currently, Cash App allows you to send and receive up to $1,000 within a 30-day period. These limits are only valid for unverified accounts, though. If you verify your account, your sending limit will be increased to $7,500 per week, with virtually no limits on what you can receive.

To access these increased limits, go to your profile and fill out the “Personal” section to verify your account. You'll need to provide your full legal name, date of birth, and the last four digits of your Social Security Number (SSN). If there’s nothing wrong with the personal data you’ve entered, you’ll receive confirmation on your email and/or phone after a few days.

By the way, the answer to the question of how to delete Cash App account on phone can be found in an article on our website.

How to Send Money From Cash App to Bank Account

Cashing out your Cash App balance and transferring it to your bank account is a straightforward process. However, note that you can only transfer the funds to the bank account linked to the platform. Besides, you won’t be able to cash out the balance to a prepaid card, which is available only for sending money with the app.

By the way, the answer to the question of is Cash App card a prepaid card can be found in a separate article.

If you have a bank account linked to your profile, here is how you can transfer funds from your Cash App balance:

- Initiate transfer by tapping “Cash Out” under your current balance.

- Enter the required amount, not exceeding your current balance.

- Select the bank and make sure you’ve picked the right one if you have several linked accounts.

- Confirm the transfer after reviewing the details to finalize the transaction.

After confirming the operation, you can monitor its progress. Transactions typically take 1-3 business days to complete, but can occasionally take longer. So, be patient if you don't immediately see the funds in your bank account.

You may also be interested in how to get money on Cash App. To find out how to do so, we suggest you visit our article on the topic.