How to Send Money on Cash App in Minutes

The era of contactless payments is booming. Today, you just need a smartphone and a smooth Internet connection to transfer funds. There is a decent choice of digital payment tools and services compatible with iPhone and Android devices that will have you set in your cashless payment endeavors.

Cash App is one such service that confidently stands out from the crowd of mobile payment systems for its unique functionality and ease of use. Sending money on Cash App is a breeze. You can make an instant money transfer to any of your phone contacts in a matter of minutes. Just set up your Cash App account, and off you go!

If you wonder how to send money on Cash App, below, you’ll find detailed instructions and helpful tips.

How to Send Money on Cash App Within the US

Ensuring quick and secure fund transfers, Cash App is widely used to send payments across the US, with over 45 billion active users throughout the states in 2023. Here is how to send money with Cash App to your relatives, friends, partners, or anyone located in the United States.

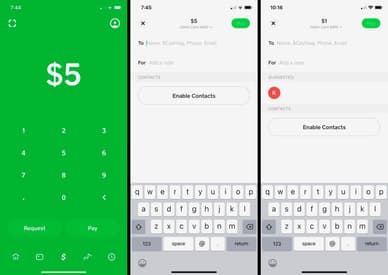

- Launch an app on your smartphone or tablet and log in by entering your credentials if it’s your first-time access.

- Enter the amount you want to send in dollars. Use the “To:” field in the center of the screen. Make sure you’ve typed in the right amount and confirm.

- Choose the recipient by entering their email address or a phone number linked to their Cash App account. Those who have linked their debit card when registering with Cash App can use the so-called $Cashtags for payments, which is a unique username. Before confirming, double-check that the recipient's information is correct.

- Add a note (optionally) to specify the purpose of the payment, adding a personal touch to the transaction. Below the amount field, there is an optional space for such note.

- Confirm payment by tapping the “Pay” button. Don’t forget to check all the entered info beforehand since this action is irreversible.

Cash App Sending Limits

When considering how to send money to someone on Cash App, remember the sending limits the system imposes on instant transfers. Currently, Cash App allows for sending and receiving up to $1,000 within a 30-day period. These limits are valid for unverified accounts, though. If you verify your account, your limits will be increased up to $7,500 per week, with virtually no limits on receiving amounts.

To access increased limits, go to your profile and fill out the “Personal” section to verify your account. You'll need to provide your full legal name, date of birth, and the last four digits of your Social Security Number (SSN). After a few days, if you fill out everything correctly, you’ll receive notification to your email and/or phone.

How to Send Money From Cash App to Your Own Bank Account

Cashing out your Cash App balance and transferring it to your bank account is a straightforward process. However, you can transfer the funds only to the bank account linked to the platform. Besides, you won’t be able to cash out the balance to a prepaid card, which is available only for sending money with the app.

If you have a bank account linked to your profile, here is how you can transfer funds from your Cash App balance:

- Initiate transfer by tapping “Cash Out” under your current balance.

- Enter the required amount, not exceeding your balance.

- Select the bank and make sure you’ve picked the right one if you have several linked accounts.

- Confirm the transfer after reviewing the details to finalize the transaction.

After confirming the operation, you can monitor its progress. Transactions typically take 1-3 business days to complete, but it can occasionally take longer. So, be patient if you don't see the funds immediately in your bank account.

Canceling the Transfer

If you need to cancel the transfer for some reason, you must act quickly. The time you have is really limited.

- Go to your activity feed by tapping the clock icon in the bottom right corner.

- Locate the pending transaction and tap on it.

- Look for an option to cancel the transfer. Remember, once a transaction is complete, you won’t be able to reverse the process and cancel it.

How To Send Money With Cash App Internationally

One of the most popular US mobile payment services, Cash App, actually doesn’t allow for international payments. Yet, you’ll have an option to exchange funds between the US and UK accounts.

How do you send money on Cash App to the UK? Well, the process is pretty much similar to that for making transfers in the US, and there will be no foreign transaction fee. Just be ready for an additional identity verification that might take place. And mind that an international transaction might take a bit longer to process.

Cash App also automatically identifies the recipient’s country and presents the transfer amount in the local currency. It converts currency at the mid-market exchange rate. This rate is the midpoint between the buying and selling rates of two currencies in the global market, and is considered one of the fairest rates available.

Final Thought

Sending money with Cash App is a no-brainer process. It is easy, straightforward, and fast. Even if you are a first-time user, you’ll get the hang of how to send someone money on Cash App without a hassle and will be able to handle the payment operation within minutes.

As such, the platform is a perfect choice for P2P payments when you need to send money to family or friends in the US or UK quickly and securely. You can also split bills, pay for services, or make purchases directly from your Cash App balance for maximum convenience.

FAQ

What is Cash App, and how does it work?

Cash App is a digital payment service developed by Square Inc. to offer a seamless contactless payment method for users to send and receive money. You need to download an app and set up an account to get access to instant transfers, direct deposits, and investment options the system provides.

How do I receive money from someone using a Cash App?

Receiving funds on Cash App is free, and if you own a verified account, you can have an unlimited number of receipts. The money will be credited to your balance automatically, and the operation will be listed in recent transactions, where you can check for the sender’s details. If someone wants to know how to send money to Cash App to you, let them know your Cash App linked phone number, email, or $Cashtag.

What are the fees and limits for using Cash App?

You can receive money on Cash App free of any charges. The same is true for Cash Card purchases and standard (1-3 business days) cash-out options. Those who seek how to send money on Cash App using a credit card should add a 3% fee to the transaction amount. Instant cash-outs (within minutes) will incur 1.5% of the total payment amount.

As for the limits, unverified accounts can send and receive no more than $1,000 within 30 days, while verified accounts are eligible to send $7,500 a week and receive without limitations.