Pros and Cons of Using Venmo [2025]

Contents

Peer-to-peer payments are a convenient way to help a friend in need, split bills, share expenses, or receive funds from relatives. With the advent of smartphones, these types of payments gained immense popularity. Today, they are commonplace for many of us, and smart mobile payment apps offer the ultimate convenience and flexibility of on-the-go financial transactions.

One such mobile app that makes online financial transactions effortless is Venmo. Launched in 2009 and acquired by PayPal in 2013, Venmo allows users to send payments in a matter of minutes using their smartphones. Its user-friendly interface, social features, and integration with bank accounts and debit cards have made it a go-to choice for millions of users across the US. It will be useful to understand how to transfer money from a bank to Venmo to ensure a successful transaction.

However, like any financial tool, Venmo has strengths and weaknesses. In this guide, we will explore Venmo pros and cons and explain how it works in more detail to help you decide whether it is the right payment solution for you.

What Are the Advantages of Venmo?

Statistics show that in 2022, the Venmo payment program had 77 million users, and by 2026, experts predict the figure will rise to 102 million. The pros of Venmo play a crucial role in its rapid popularity growth.

Free App Use

Signing up and opening a personal Venmo balance is free. The app does not charge users monthly or annual fees for its services. Receiving and sending money to a debit card, bank, or personal account is also commission-free. A fee is only charged when using a credit card or the instant transfer option.

Wide Acceptance and Integration

Venmo allows for seamless money transfers. With funds in your Venmo balance, you do not need to leave home to send money to another account or pay for a purchase. You also do not need an intermediary to send money to a family member or a friend’s card. Signing up for the app only takes a few clicks, enabling quick and easy transactions.

Venmo also facilitates payment for goods and services at companies such as Hulu, Uber, Foot Locker, Poshmark, and others, making it a convenient option for shopping and subscriptions. You can place your orders quickly and seamlessly.

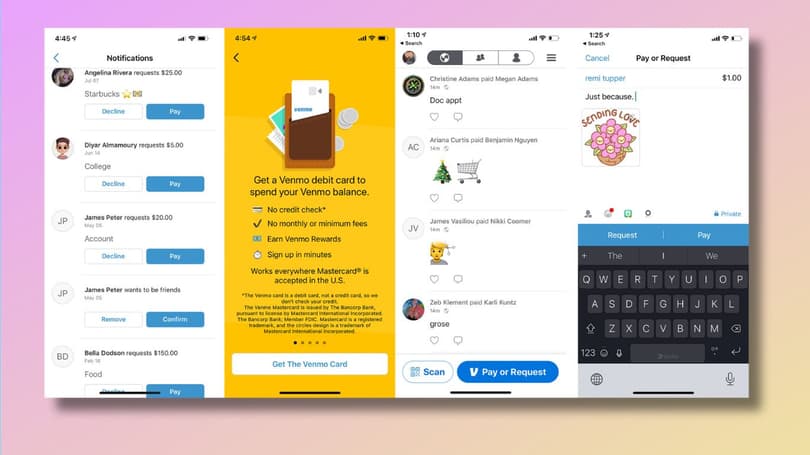

Convenient and User-Friendly Interface

Venmo’s simple interface makes it easy for new users to use the app. The settings and options menu have a logical structure, allowing for personalization. Visually appealing graphics and easy-to-read fonts only add to the appeal of this digital solution, enhancing the overall user experience.

The app also includes social features that allow you to attach comments and emojis to transfers. This functionality lets users communicate with friends while clarifying data for money transfers. Additionally, if your payments are set to "public", friends can see when and to whom you have sent funds. So, the social networking component can be viewed as either a pros and cons of the Venmo app. It all depends on your personal preferences and views on this feature.

Available Debit and Credit Cards

Users can submit an application for a Venmo debit or credit card directly through the website. There are no monthly or annual fees for their maintenance. Some stores even offer cashback rewards for purchases made with Venmo debit or credit cards. The card helps you categorize your expenses. For example, the primary spending category of purchases earns you 3% of the total amount, the second-highest spending category earns 2% cashback, and the third-highest category — 1% cashback.

Please note that if you need to withdraw cash from a Venmo card at an ATM, you can do so without any fees at MoneyPass ATMs. A $2.50 fee is charged at PULSE, Mastercard, and Cirrus ATMs.

Seamless Peer-to-Peer Transactions

The high popularity of this payment program in the USA ensures a simple process of transferring money. Most likely, your close friends and family already have Venmo installed on their smartphones, which means that you can quickly transfer money to them. If you don't have the app on your mobile device, you can easily download it from Google Play or the App Store. It’s quick to install and compatible with most smartphone models. And business owners may also find it useful to know how much does Venmo charge for business transactions to effectively plan their budget.

What Are the Disadvantages of the Venmo App?

While Venmo offers several benefits, it also has its downsides. So, what are the cons of Venmo to consider?

Privacy and Security Concerns

One of the biggest concerns for Venmo users is privacy issues. The thing is that Venmo automatically sets up public payments for new accounts. When you send money to someone, other users can see the attached message, the sender's name, and recipient’s name. The amount of the transaction also remains hidden. The good news is that you can change the privacy settings. To do so, navigate to the Privacy section and modify the settings according to your preferences.

Despite certain security risks, Venmo transactions within the system are generally safe, especially with a proactive approach to security measures.

Transaction Fees and Limits

The payment program applies a commission on these types of money transfers, including:

- Instant transfers and e-money withdrawals;

- Credit card transactions;

- Seller’s commission.

Venmo also sets transaction limits for all users. For example, for users with a verified identity, the limit for transferring money to a bank account is $19,999.99 per week. The maximum single transfer amount is $5,000. For those who haven't completed the verification process, the limit is $999.99 per week. A similar situation applies to person-to-person payments. Verified users have a limit of $60,000 per week, while unverified users have a limit of $299.99 per week. The payment system also has a Venmo daily limit, ranging from $300 to $5,000, depending on the transaction type.

No International Transfers

Perhaps the owners will expand the range of functions in the future, increasing the benefits of using Venmo. Right now, the app only works in the US with US bank accounts and payment cards. Thus, you cannot transfer money to your relatives or friends abroad.

Fraud Cases

The popularity of the app attracts not only law-abiding citizens but also scammers. There have been cases where fraudsters, using the Venmo name as a cover, demand money from users.

For example, scammers may send money to your account from an unknown sender in your account. Then, someone contacts you, claiming they made a transfer mistake and asking you to return the funds. Usually, they provide you with alternative details about where you should send the money. However, the credit card owner can report a fraudulent payment, and Venmo will deduct the same amount from your account again. So if you’ve ever wondered can your Venmo be hacked, you need to know how to prevent it in advance.

Limited Customer Support

Venmo’s customer support has some limitations. If a user sends money to the wrong person, Venmo cannot reverse the transaction and return the amount. The service can only cancel the transaction itself if the recipient agrees to cancel the transfer, there are funds in their Venmo account, and their account is in order.

However, one advantage of using Venmo is that the official site has a Help Center. Here, you can learn more about how the app works and read the terms of use. Along with the pros and cons of using Venmo, on our website, you can find materials about Venmo accounts, how to use it, and how to make a Venmo account for beginners.

Conclusion

We have reviewed the pros and cons of Venmo in detail. The app is an excellent option for those who do not have a traditional bank account but need to make regular financial transactions. Its ease of use and lack of service fees make the app a profitable alternative to usual bank transfers. However, Venmo does have drawbacks, such as security concerns, fees for certain transactions, and privacy issues. As such, it’s somewhat inefficient for instant money transfers.

Ultimately, your decision should be based on your personal financial needs, goals, and ongoing preferences. Anyway, by carefully weighing Venmo pros and cons, you can make an informed decision and determine whether it is the right payment tool for you.