What is Apple Pay?: Everything You Need to Know

Since its inception, Apple Pay has become an innovation that has heavily influenced the development of global payment infrastructure. Along with other mobile wallets, it is transforming the role of banks in financial transactions and spreading the use of digital and contactless payments worldwide. Today, Apple is constantly improving its Apple Pay payment technology, fighting for the global market with its eminent competitors, like Google Pay, and making this solution deservedly an integral element of its ecosystem.

So, what exactly does this service offer? And how can you safely send a payment using Apple Pay to someone? Keep reading this guide to learn everything about this payment technology, including how to set up the app, how the technology works, and whether it has effective security features.

What is Apple Pay?

Apple Pay is a contactless payment technology for Apple devices that makes it easy and convenient to pay for purchases in stores, apps, as well as manage your finances online. Among the key features of this payment system are convenience, security, and privacy. Apple Pay is available for all compatible devices—it can be integrated with iPhone, iPad, Apple Watch, and Mac.

What is Apple Pay, and how does it work? In fact, Apple Pay is also a type of e-wallet that moves users away from physical wallets to an environment where all debit and credit cards are securely stored on the devices and can be accessed at any time.

Getting Started with Apple Pay

So, what is Apple Pay, and how do you set it up? Connecting Apple Pay to your device is very simple and fast. In practice, the needed app is already preinstalled on Apple devices. So, let’s look at the process of setting up Apple Pay. To connect this payment solution, you must do the following:

So, let’s look at the process of installing Apple Pay on the iPhone. To connect this payment solution, you must do the following:

- launch the Wallet app on your device;

click the “+” in the upper right corner of the screen;

- among the available options, choose to add a bank card;

- read and agree to Apple’s terms;

- connect your debit or credit card by scanning its details with the camera or entering information manually.

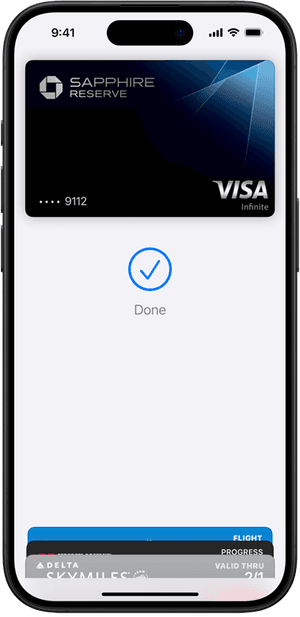

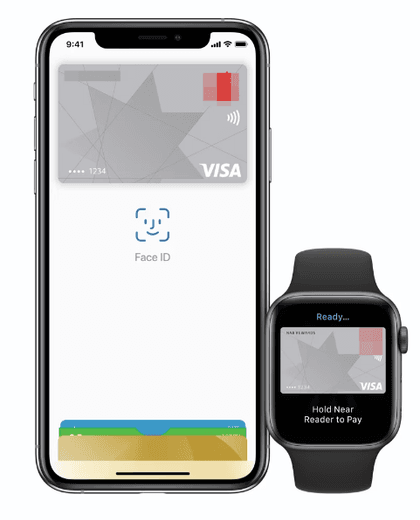

Now, you can use your mobile phone to make payments instead of a physical card or cash. And how does paying with Apple Pay work? After linking a bank card in the Wallet app on your iPhone, iPad, or MacBook, the only thing you need to do when paying is confirm the transaction through a fingerprint scan, Face ID, or password.

How Apple Pay Works

So, Apple Pay: how does it work? Let’s examine all the main usage scenarios of this payment system, explore how Apple Pay makes our lives easier, and understand why it is so popular worldwide.

Near Field Communication (NFC) Technology

NFC is a standard contactless payment technology designed to work only at close distances (about 10 cm), which allows money exchange between two NFC-compatible devices. Your device must be unlocked using Face ID, Touch ID, or a password to send payment information. This method is how we are all used to paying for purchases and services today—just put a device with activated Apple Pay close to the terminal, and the payment system installed in the smartphone shares the necessary information with the bank terminal.

Peer-to-Peer Payments with Apple Cash

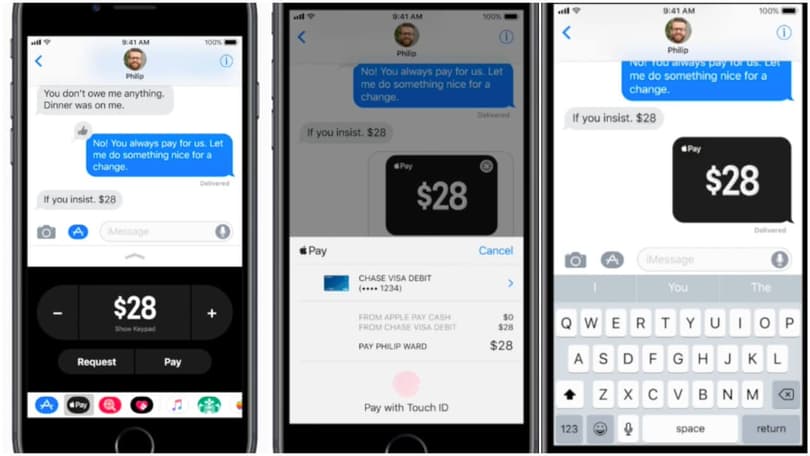

So, how does Apple Pay work on iPhone for personal transactions between individuals?

Apple Cash is one of the best and easiest ways for Apple users to send and receive personal payments on their devices. This feature is built into the iMessage app, and you can use it to make and receive payments.

The money used for this comes either from a debit card or money already on your Apple Cash account, sent to you by other users via this app. Also, the funds on your account can be used at stores that accept Apple Pay, sent to different people, or deposited into your bank account. The downside is that Apple Cash only offers peer-to-peer payments to US users.

In-App and Online Payments

Apple Pay technology allows users to buy goods or pay for services online in one click, paying for them using a bank card of all card providers previously linked to the Wallet. A financial transaction with Apple Pay does not require entering card data, which significantly speeds up the process and reduces the likelihood of an authorization error. At the same time, the card data is encrypted and is not transmitted to the seller and third parties, and to complete the transaction, the user only needs to confirm it with a fingerprint, Face ID, or password.

Security and Privacy

Apple Pay is deservedly considered one of the most secure payment systems in the world. Apple guarantees users that their payment information is safe and, in fact, safer in a device than storing the banking cards in their pockets. So, what is an Apple Pay account, and how does it work in terms of privacy and security?

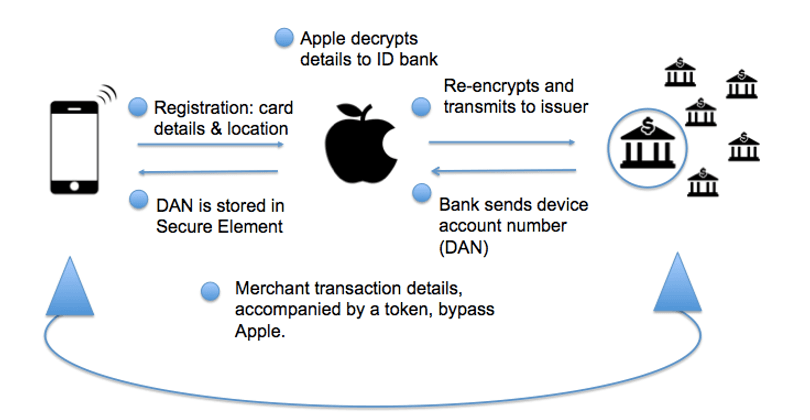

Tokenization

How does Apple Pay work and deal with your sensitive data? When you add a card, your bank details are encrypted and not stored on Apple servers. Instead, the system generates a unique code (token) that is used to make a payment. That is, when you make a payment, the seller does not receive full information about the payment card but only a dynamic code (one-time token). This keeps your financial data private and protected from unauthorized access. Even if fraudsters intercept the code, they will not be able to reuse it because it is unique for each transaction.

Secure Element

What does Apple Pay do to physically protect your data? Another protective measure is the secure element, which is basically a hardware chip, the sole purpose of which is to store sensitive data, such as payment or card details. Because it works separately from the main operating system, even when the device itself is compromised, your banking information will remain intact.

Additional Protection

Other Apple Pay security measures include domain validation and biometric authentication using Touch ID, Face ID, and skin contact (in the Apple Watch) to verify payment. All this prevents unauthorized transactions in case of theft of the device and eliminates the need to get a card or even enter a PIN code in a crowded place.

Apple does not store a complete list of card data, does not record personalized transaction data, and does not share card details with merchants. Also, if the iPhone is lost, the owner can use the Find My iPhone feature to stop any subsequent payments from the device.

Conclusion

Based on the information we provided in this Apple Pay: How Does It Work guide, it’s clear that this application deserves all the attention it gets. It is a safe and convenient method with a wide range of features and benefits. The app boasts modern security measures, from tokenization to biometric authentication and more. Setting up Apple Pay is very simple, and you can use it for contactless payments via the terminal, online and in-app shopping, as well as for P2P transfers.

Apple Pay is by far the best solution for Apple device owners who are looking for an easy way to make payments with minimal time and maximum guarantees for the security of money, cards, and data. Use this technology for a better experience and greater privacy.