What is a CVV/CVC on a Debit Card, and How Do I Find It?

Card issuers integrate a CVV (Card Verification Value) or CVC (Card Verification Code) as an essential security feature to enhance the safety of online purchases and protect against fraudulent activities. Normally, you’ll need a debit card number and CVV to complete any digital transaction, be it online shopping, paying for services on the web, or registering a subscription.

So, why is a CVV on a debit card important? Is it generally safe to tell it to third parties? After reading the article, you will find out the answers to these and other questions. Rates experts explain in detail what a CVV/CVC on a debit card is and in what cases it is used.

What is CVV/CVC?

Although plastic cards have long become commonplace, not everyone knows what a CVC number on a debit card is. This is unsurprising because we pay little attention to this code, which sometimes leads to problems.

A CVV/CVC on a card is a three-digit numeric code typically found on the backside. It’s distinct from the card number and expiration date. Its primary function is to authenticate card-not-present transactions, such as online or over-the-phone purchases, by verifying that the individual completing the operation possesses the physical card. This extra layer of security significantly reduces the risk of unauthorized use of debit card information.

A CVV/CVC should not be confused with a payment instrument’s PIN code, as they have significant differences. The latter serves only to authenticate the cardholder or, more precisely, to confirm transactions at the POS, withdraw cash from ATMs, and interact with self-service terminals.

A CVV/CVC and CVV2/CVC2 are card identifiers unique to each payment instrument. They are generated by special algorithms based on large amounts of data. Therefore, such a code cannot be faked or accidentally guessed.

WHERE CAN A CVV/CVC BE FOUND?

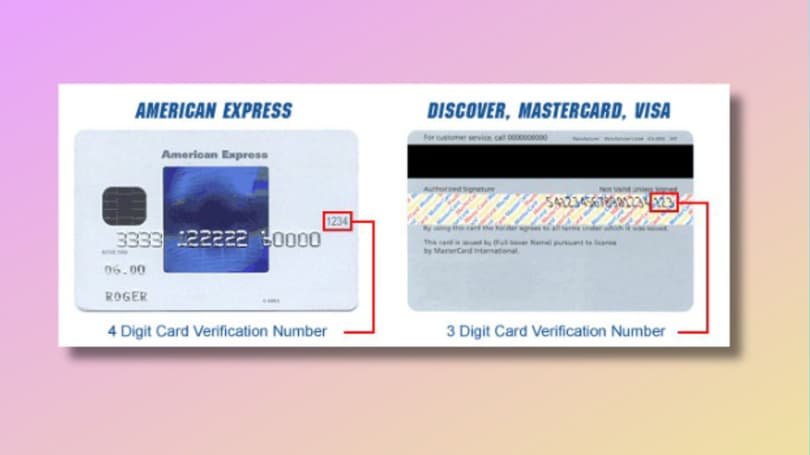

What a CVC code on a debit card is and where to find it depends on the type of payment instrument. We will consider three typical options: Visa/Mastercard, American Express, and Discover.

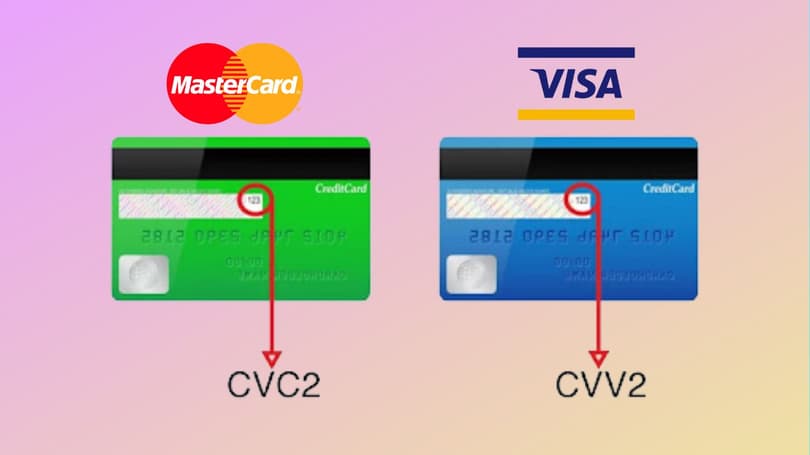

Visa/Mastercard

What is CVC in a Visa card? As you can see in the example, the numbers are printed directly under the magnetic tape on the card’s backside. The magnetic tape also contains this code, which allows you to read the information without manually entering the number in the POS terminal.

By the way, good Visa credit cards offer very favorable conditions for using this payment system. You can learn more about Visa credit card and how it works in our additional article.

American Express

There are two fundamental differences between Visa/MasterCard cards—the length of the code and its location. In the previous example, the code was printed on the back side of the plastic payment instrument, and on AE, it was on the front side. Also, pay attention to the number of characters. There are four of them here, not three, as in other cards. This is done purposely to minimize the risks of a CVV/CVC being guessed or generated by attackers.

Discover

Here, the placement and length of the code are identical to Visa/MasterCard. A CVC is also on the back of a card and consists of three digits.

If you have a Visa gift card, check balance you can always very easily by reviewing our material about this card.

Protect your funds

Now you know what a CVC on a debit card is and its location. However, you should also know about its importance and methods of code protection from attackers. You don’t have to worry about paying offline because you don’t need this number for in-store purchases. However, for online transactions, a CVV/CVC is required because it acts as a verification code for the user. Accordingly, anyone who knows the card number, its expiration date, and the specified code can use your money to purchase goods or order services online.

To protect yourself, follow the recommendations of Rates experts:

- Do not share the code with third parties.

- Use special pockets or covers for storing cards.

- Try to avoid keeping cards in the area covered by digital cameras in supermarkets, etc.

- Cover the code with your finger so that cashiers or other customers cannot see it.

- Carefully stick a piece of paper or a holographic label to where the code is printed.

Conclusion

While a three-digit number on the reverse side of your card may seem insignificant at first glance, its role in verifying the legitimacy of online transactions cannot be overstated. Understanding what a CVV on a debit card is and knowing how to find it will let you avoid careless handling of a plastic card that may lead to financial losses. Therefore, do not share this data with third parties, hold means of payment in secure, opaque containers, and check the websites where you conduct digital transactions. The safety of your funds depends primarily on your prudence and caution. By adopting best practices for safeguarding your debit card number and CVV, you can minimize the risk of falling victim to fraud and enjoy peace of mind when making transactions online or over the phone.

FAQ

What is a CVC on a debit card?

A CVV is the 3 or 4 digits on the card used to authenticate online transactions. They also play the role of protecting your finances from criminals. If you understand what a CVV number on a debit card is, you can protect your data from intruders.