Helcim Review: How It Works, Pricing, and Benefits (2024)

Are you on the lookout for a reliable payment processing service for your business? If so, chances are you’ve probably already come across Helcim. Thanks to its range of features, dependability, and competitive pricing, Helcim has been steadily gaining traction among business owners in the US and Canada.

No matter what kind of business you run, picking the right payment processor is crucial. In this detailed Helcim review, we’ll walk you through the system, how it works, pricing details, and its key advantages, helping you figure out if it’s the best fit for your business.

What Is Helcim?

Launched back in 2006, Helcim is a standout payment processing platform designed for businesses in the US and Canada. While it caters to businesses of all sizes, it’s particularly well-suited for merchants with higher sales volumes and those who have already gotten themselves on solid ground.

Since its inception, Helcim has evolved into one of the leading payment processors, offering a range of out-of-the-pocket solutions for online and in-person transactions. The platform focuses on:

- Convenience;

- User-friendliness;

- Diverse functionality;

- Top-notch security.

Helcim: How Does It Work?

Distinguished by a strong track record, solid market reputation, and high customer scores (it’s enough to check a few Helcim reviews), the platform provides several ways for businesses to accept payments:

- Merchant accounts: Helcim allows businesses to accept credit and debit card payments through individual merchant accounts, offering a seamless experience for customers.

- Virtual terminals: If your business takes orders over the phone or by mail, Helcim payment processing allows merchants to manually input payment details, making it easy to process transactions without needing physical cards.

- Mobile apps: With apps developed for Android and iOS, Helcim makes it a breeze to handle mobile payments and transactions on the go.

- Payment gateways: By embedding Helcim’s payment gateway into third-party software or a shopping cart, allowing customers to make secure online purchases using a variety of payment methods.

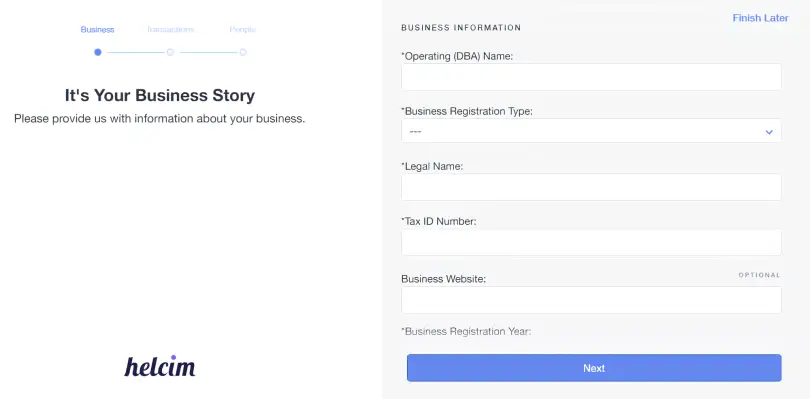

To unlock Helcim features and start using the system, you’ll need to visit their website and complete the registration process. You’ll need to provide some basic business information and undergo an application review, ensuring compliance with regulatory standards. Helcim makes it as straightforward as possible so you can get up and running quickly.

If you need in-store payment terminals, Helcim offers hardware options that are easy to set up. Simply connect them to your network and integrate them with your Helcim account.

One thing many other Helcim credit card processing reviews might leave out is that the company also provides useful digital tools. A customer manager helps track client data, an inventory manager organizes sales data across different payment points and stores them online, and a credit card vault keeps sensitive credit card information secure.

Helcim Payment Processing Review: Pricing

Maintaining all payment options required by small businesses, Helcim prioritizes transparency and a fair approach when it comes to pricing, with no monthly fees, setup costs, user charges, cancellation, or other hidden fees lurking in the fine print.

Rather than using flat rates, which charge a fixed percentage regardless of transaction volume, Helcim employs a tiered pricing structure. This means that as your business scales and monthly transaction volume increases, your fees per transaction decrease incrementally, helping you save as you grow.

Helcim opts for an interchange-plus pricing model, which means they pass the actual interchange rates set by card networks directly to merchants. Here's an idea of how the pricing breaks down for different transactions:

- In-person payments: For up to $50,000 in monthly card sales, you’ll pay 0.40% interchange plus fee $0.08 per transaction. For up to $100,000 in monthly sales, the rate drops to 0.35% plus $0.08 per transaction.

- Online payments: For online sales up to $50,000, 0.50% interchange plus + $0.25 per transaction Helcim charges 0.50% plus $0.25 per transaction, with fees dropping to 0.45% plus $0.20 as your monthly volume grows.

- ACH payments: ACH transfers come with a rate of 0.5% + $0.25 per transaction.

Helcim’s tiered pricing structure helps businesses forecast their processing costs and potentially cut down on them as their sales increase.

Why to Choose Helcim: Key Advantages

How does paying with the Helcim payment platform benefit your business? The company stands out in the payment processing landscape by offering a range of advantages tailored to meet businesses’ diverse needs. Here are some of its biggest advantages:

Transparency

Helcim is upfront about its transparent pricing models created to match the varying financial needs of small businesses and maintain their scaling endeavors. You can find processing fees on the company’s website, and you can use their online calculator to find your individual rates and calculate potential savings. Although interchange-plus rates differ depending on the monthly transaction volume, they’re broken down into five simple tiers.

Comprehensive Service

Helcim works across a wide range of industries, including retail, e-commerce, or service-based businesses. It’s an all-in-one solution offering plenty of features and extra tools to improve the user experience and boost customer satisfaction.

Security

When it comes to payment processing, security is crucial. Helcim takes it seriously, employing robust security measures, including encryption, multi-factor authentication, and compliance with industry standards. This ensures that sensitive payment information remains protected throughout transactions.

Conclusion

Whether you’re a small business looking for efficient payment processing or a growing enterprise wanting to streamline your transaction processes, Helcim's all-comprehensive services can meet your needs.

Give Helcim a try today and discover a payment processing solution designed to enhance your business operations while keeping transparency, security, and efficiency at the forefront.

![Can You Cancel a Zelle Transaction? [A Complete Overview]](https://rates.fm/static/content/thumbs/385x210/6/dd/z35tj7---c11x6x50px50p--6b1cd775dedab0b7c43715cbb8917dd6.png)