Helcim Credit Card Processing Review: What You Need to Know

To survive and thrive, any modern business needs an effective card processing solution. While there are currently plenty to choose from, some stand out with their features and advantages more than others. One of the most reputable options is the Helcim credit card processing tool, which works well for businesses of different types.

The service allows you to process credit card payments easily, regardless of the scale of your business. At the same time, it has plenty of peculiarities you need to be aware of. Keep reading this Helcim card processing review to learn about Helcim features, plans, fees, and more.

FEATURES OF THE HELCIM CREDIT CARD PROCESSING SOLUTION

To access features associated with Helcim payment processing, you need to have either its Smart Terminal or branded card reader. When you get a Helcim account, you will be able to use the company’s software. Some features you can enjoy include:

- Management of subscriptions. By using Helcim, a merchant can come up with customizable plans for their clients. It is also possible to ensure that recurring payments are dealt with automatically.

- Automatic invoicing. Business owners can benefit from the automatic calculation of sales taxes.

- Creation of payment pages. With Helcim, you can create payment pages in your online store. As a result, you can allow customers to register, pay for invoices, donate, subscribe, etc.

Moreover, some features will help you manage your business:

- Management of products. With this useful feature, you will always know information about your inventory, can set up alerts for when you are running out of products, and view what items sell best.

- Management of customers. This is a crucial feature for storing all customer-related details, which includes everything from order history to credit card information and more.

COST OF HELCIM CARD PROCESSING PLANS

Helcim operates on a transparent pricing model, primarily utilizing the interchange-plus approach. This approach involves passing the actual interchange fees set by card networks (Visa, Mastercard, etc.) directly to the merchant, alongside a fixed markup from Helcim. This structure ensures businesses pay the real processing cost plus a modest margin for Helcim's services.

As of 2024, the fee charged for in-person transactions is 1.93% plus $0.08. If a customer performs either a keyed or online transaction, the current Helcim fee is 2.49% plus $0.25. For the convenience of clients, the company provides a Helcim card processing fees calculator so you can determine your fees based on the volume of sales, business type, etc.

Additional fees

When we compare it with other payment systems, Helcim seems to be an obvious choice. However, you shouldn’t forget that those are only average fees set by card networks. Helcim charges an additional 0.4% + $0.80 for in-person transactions or 0.5% + $0.25 for online transfers, making it more expensive than some other payment processors.

Discounts and free trial

At the moment, Helcim does not offer discounts, if not counting different plans, which are based on processing amounts. This is not such bad news, considering that the company doesn’t charge cancellation, monthly, or setup fees. Also, there is no free trial in a traditional sense, as you get access to a free version of a Helcim account and then pay for transactions.

Cancellation and refund

You can cancel your account whenever you need to by simply contacting customer support. No cancellation fee is charged for this. However, depending on your specific situation, you may not get refunds.

Additionally, if you are not satisfied with the purchased hardware, you can return it during the first 30 days of using it, and you will get your money back if you meet the requirements.

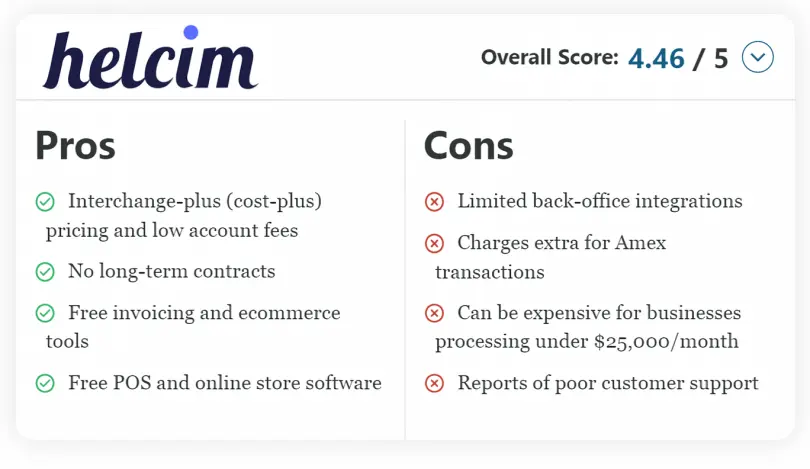

Helcim Pricing Pros:

- Flexibility and volume discounts, making rates adaptable to changing business needs.

- Affordable and competitive fee for ACH payments, with no interchange rate attached.

- Transparent pricing model overall, with no hidden charges or intricacies to it.

Helcim Pricing Cons:

- Starting Helcim credit card processing fees might appear less cost-effective for startups or small businesses with lower transaction volumes.

- Quite high hardware cost.

Helcim Payment Pros:

- Helcim's payment options are designed to integrate with different systems and platforms, ensuring a smooth experience for both merchants and customers.

- With robust encryption and adherence to industry-standard security protocols, Helcim prioritizes transaction safety, instilling trust among consumers and merchants alike.

- The platform accommodates various payment methods, catering to diverse customer preferences.

Helcim Payment Cons:

- Helcim’s integration capabilities are not as robust as those of bigger platforms like Square or Chase. Yet, the vendor keeps building up their integrations.

- Acquiring the necessary hardware for in-person transactions could involve upfront costs, potentially impacting small businesses with stringent budgets.

What Plans Are Offered by the Company?

Helcim card processing reviews cannot be completed without discussing the company’s plans. When you add Helcim to the mix for your business, you should know that the price plans offered by the company depend on the volume of your transactions and also on whether they were in-person or keyed/online.

Here are the five plans implemented by Helcim based on the mentioned factors:

- From $0 to $50,000. Customers are charged 0.4% plus 8 cents for in-person transactions, and 0.5% plus 25 cents for online and keyed purchases.

- From $50,001 to $100,000. Customers are charged 0.35% plus 7 cents for in-person transactions, and 0.45% plus 20 cents for online and keyed purchases.

- From $100,001 to $500,000. Customers are charged 0.25% plus 7 cents for in-person transactions, and 0.35% plus 20 cents for online and keyed purchases.

- From $500,0001 to $1 million. Customers are charged 0.2% plus 6 cents for in-person transactions, and 0.25% plus 15 cents for online and keyed purchases.

- From $1,000,001 and above: Customers are charged 0.15% plus 6 cents for in-person transactions, and 0.15% plus 15 cents for online and keyed purchases.

Based on the numbers and Helcim credit card processing reviews, it is obvious that businesses with higher transaction volumes are rewarded with lower per-transaction fees. This scalable pricing strategy maintains business growth while retaining affordability. As compared to other leading credit card processors like Square, Stripe, and PayPal, Helcim is a more cost-effective solution for businesses processing higher volumes of operations and seeking to optimize their expenses as they scale.

![Can You Cancel a Zelle Transaction? [A Complete Overview]](https://rates.fm/static/content/thumbs/385x210/6/dd/z35tj7---c11x6x50px50p--6b1cd775dedab0b7c43715cbb8917dd6.png)