Is Cash App a Prepaid Card: Everything You Need to Know

With millions of people using digital payment apps every day, Cash App has become a household name. The service is exceptionally easy to use, but many users still struggle with questions like “Is CashApp card a prepaid card?” and “What is Cash App and how does it work as compared to a traditional debit card?”

In this guide, we’ll discuss how Cash App deals with prepaid and debit cards and what it means for you as a customer.

Prepaid Cards And How Cash App Works With Them

Prepaid cards are simply physical or virtual cards with a certain amount of money the user puts there in advance. They function like debit or credit cards but are not linked to any specific bank account, which means the users can only spend the funds available on the card itself. Once this balance is depleted, you can replenish the card to continue using it.

Debit cards are somewhat similar, but are directly linked to a bank account. In other words, a debit card gives you access to all the funds in your account, while a prepaid one has only what you’ve put in.

Can You Use a Prepaid Card on Cash App?

If you have a prepaid card, you can use it to send money on Cash App to friends, family, or anyone else in your contacts.

However, it's important to note that the platform does not allow users to add cash to their balance using a prepaid card. Keep this distinction in mind to avoid nasty financial surprises.

What Prepaid Cards Work With Cash App?

Now, we’ve come to the most interesting part: How can you use a prepaid card on CashApp, and which ones are the best for it? While the app itself allows using prepaids, specific cards' compatibility may vary. Therefore, it's advisable to check with the issuer or consult Cash App's support for up-to-date information on supported options.

Let’s see which prepaid cards work with Cash App:

Visa

Can I use a prepaid card on Cash App if it’s Visa? Yes, very much so. In fact, there are numerous Visa prepaid cards that you can use with Cash App. One of the prominent options is the Netspend Prepaid Visa, which works well for individuals with low credit scores or those who don’t yet have a bank account.

Another popular prepaid card to consider is the Green Dot Prepaid card. It doesn’t have an annual fee and can be easily activated online after purchase. A significant advantage of a Green Dot is that it can be reloaded through a mobile deposit.

Some other Visas that you may consider using with Cash App are:

- Cashpass Visa Prepaid Card;

- NexsCard Prepaid Visa;

- Unidos Visa Prepaid Card.

Mastercard

Mastercard offers a range of different prepaids that work with Cash App. For instance, you can use Brink's Prepaid Mastercard. While the bank doesn’t charge for activation, you should keep in mind that it comes with a monthly maintenance fee of $9.95. However, you can get cashback rewards at select merchants.

Another interesting Cash App prepaid card is PayPal Prepaid. This is an excellent option if you want to avoid a credit check, and it has some great features. Similar to Bink’s Prepaid Mastercard, you will get cash back from select merchants, which is not that common for prepaids. The PayPal Prepaid Mastercard has a $4.95 monthly fee per the issuer; there’s also no activation fee, even if you order the card online.

American Express

American Express Serve has a $6.95 monthly fee, waived in months with $500+ in direct deposits. However, note that the Serve prepaid program will be discontinued on June 2, 2026. Similar to the majority of prepaids, it doesn’t offer cash back or free reloads.

Bluebird has no monthly fees, but the program is also to be discontinued on June 2, 2026.

You can utilize each of these cards to send payments through the app within your established prepaid card’s limit. To find out how to get money on Cash App for free, review the promotions and discounts offered by the provider.

Debit Cards And How Cash App Works With Them

Debit cards are a more convenient financial tool, providing you with access to all the funds in your bank account. As they are linked directly to your account, you can make purchases, withdraw cash from ATMs, and conduct online transactions. Unlike credit cards, which extend a line of credit to the user, debit cards allow you to spend up to the available balance in the linked bank account.

Debit cards differ from their prepaid counterparts in that the latter are bound to a balance limit, not to your account balance. In practice, this means you’ll have to replenish a prepaid card manually, while a debit card will always have all the funds you’ve got in its linked account.

Cash Card From Cash App

Cash App has its own free card, aptly named the Cash Card. It’s a useful addition to the service’s virtual ecosystem, providing users with a physical plastic they can use for payments and withdrawals. The Cash Card is affiliated with Visa, one of the world's largest payment networks, and can be used at any location where Visa is accepted. There’s no monthly fee, but Cash App charges $2.50 per ATM withdrawal, a 3% foreign transaction fee, a $1 paper money deposit fee, and 0.5–1.75% (min $0.25) for Instant transfers. It is also worth noting that Cash App fees to send money are quite low compared to other providers.

But is a Cash App card a prepaid card? The answer is no. The Cash Card is a debit card linked directly to your Cash App account, which, in turn, can be linked to your bank account. With this card in hand, you are free to make in-store purchases, online transactions, and ATM withdrawals, all using the funds in your Cash App balance. This adds a layer of convenience for Cash App users, allowing them to access their money in a tangible, real-world context.

If, for some reason, you are not satisfied with the app, visit our guide on how to delete a Cash App account.

Final Thought

Is Cash App a prepaid card? No, it is not. However, it’s still a convenient mobile payment service that can be used with different types of cards. Cash App is also compatible with a wide selection of prepaid and debit cards. And if you want a physical plastic directly tied to your Cash App account, a Cash Card by Visa comes with a ton of benefits for real-world use.

FAQ

What are the benefits of using Cash App?

Cash App is a convenient platform for handling financial transactions. Its ease of use and versatility have made it a popular choice among a wide range of users, from individuals to small businesses.

Is a CashApp card a debit card or a prepaid one?

In a word, it’s neither of these. Technically, it’s a mobile app that doesn’t operate as a bank card in a conventional sense. While it allows users to hold a balance within the app, this balance is a digital representation of funds, and it doesn't function as a standalone card.

Why is Cash App considered a prepaid card?

The confusion may occur due to the Cash Card, a physical card issued by Cash App. The app itself is a digital platform with extensive functionality that goes beyond that of a regular prepaid card, but can’t be considered a bank card in a traditional sense.

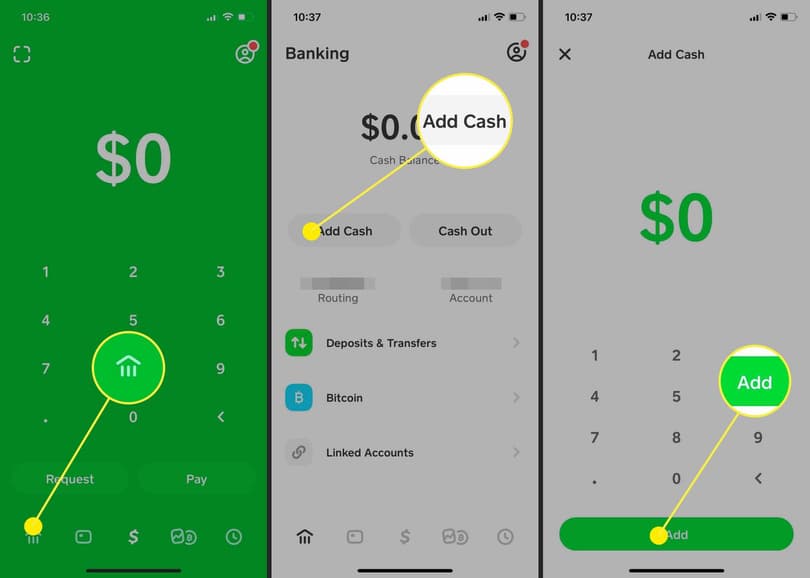

How can I add a prepaid card to Cash App?

To add a card, tap your Profile icon → Linked Banks → Link Debit Card, then follow the prompts (Cash App doesn’t document an “Add Card” option on the Balance tab).