PayPal Pay in 4: Detailed Overview

Contents

The Buy Now, Pay Later (BNPL) shopping model is gaining traction, with new services emerging every day. With the help of services like PayPal Pay in 4, a convenient payment solution that lets you purchase items without paying the full amount upfront.

So, what is PayPal Pay in 4, and how does it work? It is a special customer loan from PayPal, which splits your purchases into four equal installments, allowing you to pay off the total amount over six weeks. In this PayPal Pay in 4 review, we’ll cover how to get PayPal Pay in 4, its important features, eligibility requirements, and other peculiarities. Keep reading to find out everything you need to know.

How Does PayPal Pay in 4 Work?

First, let’s deal with who accepts PayPal Pay in 4. PayPal 4 payments are accepted by millions of online merchants worldwide. It covers a broad range of categories like clothing, cosmetics, electronics, and household goods. Popular retailers include Apple, Home Depot, Villeroy & Bosch, Pandora, Levi’s, Puma, Michael Kors, and Columbia, and these are just a few big names to mention from a list of participating merchants.

How to use Pay in 4 PayPal? Designed with simplicity and user convenience in mind, it’s a no-brainer payment method that involves a few easy steps to get started.

Payment Process

The mechanics behind PayPal Pay in 4 are very simple. PayPal divides the total purchase amount into four installments, hence the name of the service. During checkout, PayPal pays the merchant the full amount of your purchase while you make your first installment. The remaining three payments are automatically deducted from your linked payment method directly to PayPal over six weeks.

Repayment Schedule

The countdown for your next payments starts with your initial payment for the purchase. After that, subsequent payments are due every 15 days. For example, if you are going to purchase an item that costs $600, you will have to pay $150 when completing the transaction and make three more $150 settlements in 15-day intervals. PayPal doesn’t charge interest on installment payments, and there are no other processing fees.

Automatic Payments

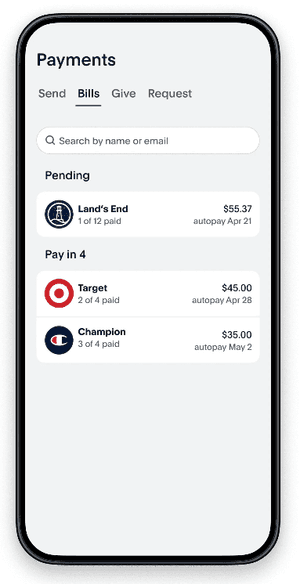

The great thing about the service is that payments are automatically deducted from your chosen payment method. This is highly convenient, as it ensures that you don’t forget about your payment obligations and miss a due date.

Who Is PayPal Pay in 4 Available to?

Before applying for PayPal’s Pay in 4 loans, make sure you are eligible for this BNPL service. There are a few requirements you should match:

- Be at least 18 years old.

- Have an active PayPal account linked to a valid debit or credit card.

- Spend between $30 and $1,500 on a purchase.

- Reside in a state where the service is available (not Missouri and Nevada).

Notably, the PayPal system is set to perform automated internal checks of your shopping history and creditworthiness during the application process. While the approval process is quick, the reason for denial could be poor credit history, recently rejected payments or any previous payment issues. Additionally, PayPal Pay in 4 availability depends on the merchant and may exclude certain service providers or subscription services.

Who Is PayPal Pay in 4 Best For?

Now that you know how to apply for Pay in 4, let’s discuss who this service is particularly beneficial for. This service is ideal for such categories of customers:

- Shoppers Without Full Upfront Funds: The most obvious category is people who need to make essential purchases but lack the full amount initially but are confident they will be able to pay the amount over 6 weeks.

- Credit-Conscious Consumers: Those who want to keep their credit use to a minimum will benefit from Pay in 4. PayPal performs a soft credit check, so this won’t cause a drop in your credit score.

- Non-Traditional Borrowers: People who don’t want to get a personal loan or don’t even have a credit card can benefit from this service.

- Purchase Protection Seekers: The payment service offers purchase protection, so if there are issues with whatever you buy, you will get a refund.

How to Use PayPal Pay in 4: Step-by-Step

Let’s take a look at how to Pay in 4. Here are the steps that the process involves:

- Add Items to Your Cart. When shopping on the website of a participating merchant, you should add items you want to buy to your cart as usual.

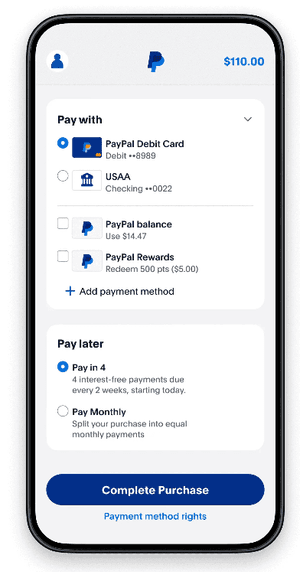

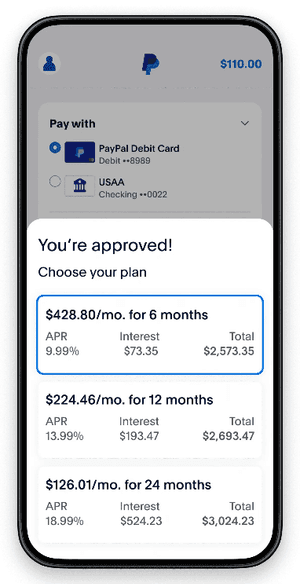

Select PayPal Pay in 4. Once you are ready to pay, select PayPal as your payment method and choose Pay 4 payments during checkout. Review the provided loan agreement terms.

Submit an Application. You will see a short application you need to fill out and submit. This will result in a soft credit check, and if approved, you’ll receive instant confirmation.

- Complete the Purchase. After that, all you have to do is pay your first installment, which will be a fourth of the entire purchase sum.

Make Remaining Payments. Every 15 days, you will be automatically charged the remaining amounts by PayPal.

PayPal Pay in 4 Related Fees and User Support

With Pay in 4, the ability to pay the purchase cost in parts across a lengthy period of time comes free of charge. It means there will be no associated fees, rates, or charges to cover. You even have the option to pay off the remaining purchase balance in full at any time without penalties. At the same time, though, you should be wary of potential problems if you miss a scheduled payment or have insufficient funds in your linked account.

Should you get into any dubious situations or have any issues with the Pay in 4 product, PayPal’s support team will be ready to help. You can find responses and solutions to any common issues on PayPal’s help page or in the community forum. For personalized assistance, feel free to call the helpdesk or contact the resolution center by logging into your account.

PayPal’s Pay in 4: Advantages and Disadvantages

Is PayPal Pay in 4 good? At this point, it’s clear that this service is a lucrative option for financially responsible avid shoppers and anyone who wants a simple BNPL plan. However, before making a final decision on using this option, it's worth taking a close look at its benefits and drawbacks and how they compare.

Pros:

- Zero Interest: Interest-free installments make Pay in 4 a cost-effective option, enabling shoppers to buy items they cannot afford outright.

- Accessibility: Minimal credit check requirements make this payment method accessible to a broader range of consumers, including those with less-than-perfect credit histories.

- Ease of Use: Even if you are new to BNPL services, using Pay in 4 is a breeze. An intuitive checkout process and quick approval are a match for novice users.

- Purchase Protection: You won’t have to worry about manually making installment payments. The system automatically deducts the scheduled payments from your linked payment method. Refunds for disputes ensure peace of mind.

- Wide Acceptance: Accepted at millions of online stores globally, it’s a versatile payment solution for various shopping needs. You can pay in any supported currency; the system will automatically convert it to USD.

Cons:

- Online-Only Usage: Pay in 4 isn’t available for in-store purchases, while many other providers offer BNPL plans for digital and offline stores alike.

- Low Spending Limit: With a maximum purchase limit of $1,500, Pay in 4 is not an option for substantial purchases exceeding that sum.

- No Payment Rescheduling: If you are unable to make the payment in time for some reason and want to reschedule the due date, you won’t have this option with a Pay in 4 BNPL plan.

- Refund Process Issues: If you decide to return the item purchased under PayPal’s Pay in 4 program, you’ll still have to stick to your payment schedule until the refund is processed.

- Risk of Collections: Though your account won’t be paused in case of missed payment, PayPal tends to send non-diligent debtors to collectors, which might adversely affect your credit score.

PayPal Pay in 4 Loan Alternatives

Even though PayPal Pay in 4 is a great option for most, it’s still useful to know about other alternatives so you can make an informed decision.

Other BNPL Services

There are many BNPL services out there, and some of the most popular ones include the following:

- Klarna: Compared to PayPal, you get more payment options and flexibility with Klarna. For example, you can choose Pay in 4 or Pay in 30. Also, Klarna offers financing for extended periods (up to 36 months), but they come with interest charges.

- Afterpay: This service shares the approach with PayPal, with four payments spread out over six weeks. The advantage of Afterpay as opposed to PayPal is that you can also use it offline in stores. The downside is that Afterpay charges a late payment fee, which can reach up to 25% of the purchase amount.

- Affirm: This service allows you to not only pay in 4 installments every two weeks but also monthly, from 3 to 60 months. Similarly to Klarna, monthly financing comes with interest charges. The good thing is that it doesn’t charge late fees, just like PayPal.

Personal Loans

With a personal loan, you get longer repayment periods compared to just six weeks of PayPal. However, because you may extend the repayment for months, this option comes with interest rates. Another downside of a personal loan is that you need to have a certain credit score, stable income, and a bank account. The advantage is that you don’t have to pay in installments, as personal loans offer lump-sum payments.

0% APR Credit Cards

Another alternative is a credit card with 0% APR. Many cards offer introductory 0% APR for months, but you need credit approval to get one. If you don’t have a sufficient credit score, which needs to be in a good to excellent range, you won’t get a credit card with this benefit.

Conclusion

PayPal Pay in 4 is a groundbreaking solution in the realm of accessible digital payment solutions. PayPal revolutionizes the online shopping experience by making it more accessible and manageable for consumers. It empowers shoppers to make responsible purchases within their means. At the same time, it’s essential for users to carefully weigh all the advantages and disadvantages of this BNPL plan while thoroughly assessing their financial situation to avoid overspending or making impulsive buying decisions.