Venmo Limit: What You Need to Know Before You Send or Receive Money

Venmo, a US digital wallet service owned by PayPal, dominates the P2P market with its highly convenient and fast transactions. Like other digital payment apps, Venmo has many security features. Along with PIN, biometric, and two-factor authentication, the system limits transactions to prevent fraud and unauthorized access. Active users should stay aware of these limits to avoid any unpleasant surprises when using the service.

In this article, we will discuss everything about the regulations of this popular payment system. What is the Venmo send limit per day? How can you check your Venmo transfer limits and increase them? Keep reading if you want to get the most out of your Venmo experience!

Understanding Venmo’s Transaction Limits

First of all, we need to talk about the reasons Venmo limits transactions at all. The main reason is to ensure safety — protecting users' funds from hackers and complying with the industry-standard legal requirements. Note that Venmo transfer limits, just like Venmo charges, vary based on the transaction type, your account status, and previous activity.

Venmo has multiple transaction restrictions, which vary depending on whether the user's identity has been verified. Before using the service, you should find out how much you can send on Venmo for free and what the limits are.

Unverified accounts

Weekly Spending Limit: $299.99 (for person-to-person payments).

Bank Transfer Limit per Week: $999.99 (applies to transfers to a linked bank account).

Verified accounts

Weekly Spending Limit: Up to $60,000 on sending funds and up to $7,000 for combined purchases, which allow you to:

- Use your in-store QR code;

- Checkout online using Venmo;

- Use Venmo in other apps.

Bank Transfer Limit per Week: Up to $19,999.99 (applies to transfers to a linked bank account).

Venmo Max Transfer per Day: $5,000 per transaction.

Venmo Limit Categories

As you can see, the limits for verified and unverified accounts are very different. Unverified profiles have limits placed on all transaction types, regardless of whether you use the service for purchases or money transfers. Verified users, on the other hand, enjoy quite generous thresholds, making it possible to use Venmo even for high-end purchases. This rule applies to personal and business profiles alike.

Before we discuss each Venmo limit in more detail, let’s first look at what types of payment restrictions the service imposes.

- Sending thresholds: While Venmo does not limit the amount of money you can receive, the service sets a cap on funds users can send per transaction, per day, and per week. The weekly limitations are the most common ones you’ll encounter.

- Bank transfer thresholds: The service limits your per-transfer and weekly amounts when cashing out money from your Venmo balance to your bank account or depositing money to Venmo.

- Purchase thresholds: When using Venmo to make purchases, whether online or in-store, specific limits apply to transactions you can make within a week.

- Weekly rolling thresholds: Venmo employs a “weekly rolling limit” system, which tracks a user’s transactions over a seven-day period. The threshold resets on a rolling basis, meaning that if a user sends $100 on Monday, this amount will no longer count against their limit the following Monday, but the funds they have sent in the following days will still do.

Did you know that Venmo is one of the top three leading online payment brands in the US?

Personal Profile Limits

How much can you send on Venmo in one day or week? The limits also depend on your account type.

If you sign up with Venmo without verifying your identity, your weekly threshold for purchases and sending funds is $299.99, while your bank transfers are also capped at $999.99 per week.

Once you complete the verification procedure, your weekly thresholds will increase to $60,000 for sending funds and $7,000 for combined purchases. The latter includes all types of transactions tagged as “Purchases” you’ve made offline or online with eligible merchants. The bank transfer limit for verified users is increased to $19,999.99 per week. Remember, though, that you won’t be able to withdraw more than $5,000 per transaction.

If you use a Venmo debit card, it will be automatically linked to your Venmo account balance, but the service also has some card-specific limits in place. Thus, you can spend no more than $2,999.99 per purchase and no more than $3,000 on purchases per day (with an overall weekly purchase threshold of $7,000). The transaction limit for ATM cash withdrawals is $1,000 per day.

Finally, deposits to your Venmo account are limited to $10,000 per week for bank transfers and $2,000 per week for debit card payments.

Weekly Limit | Non-Verified Personal Profile | Verified Personal Profile |

|---|---|---|

Sending money | $299.99 | $60,000 |

Purchases | $299.99 | $7,000 (combined) |

Bank Transfer | $999.99 | $19,999.99 |

Adding money to your Venmo personal account | $10,000 using a bank $2,000 using a debit card | $10,000 using a bank $2,000 using a debit card |

Did you know that, as of early 2025, Venmo has approximately 92 million active users?

Business Profile Limits

Venmo business profiles have a separate set of payment and transfer limits. Non-verified accounts are limited to $2,499.99 in purchases and transfers, and to $999.99 in bank transfers per week. However, you won’t be able to access any funds at all if you don’t know how to add cash to Venmo, and if you haven't learned to use this service, yet you can find all the relevant info in the linked article.

Verified profiles have a $25,000 weekly threshold for sending money through the service. Meanwhile, a weekly restriction for bank transfers is increased to $49,999.99. When making instant transfers, you must limit yourself to $10,000 per transaction to your debit card and $50,000 to your bank account.

Weekly Limit | Non-Verified Business Profile | Verified Business Profile |

|---|---|---|

Sending money | $2,499.99 | $25,000 |

Purchases | $2,499.99 | $25,000 |

Bank Transfer | $999.99 | $49,999.99 |

Adding money to your Venmo business account | $10,000 from a verified bank account $2,000 from a linked debit card | $10,000 from a verified bank account $2,000 from a linked debit card |

How to Increase Venmo Limit

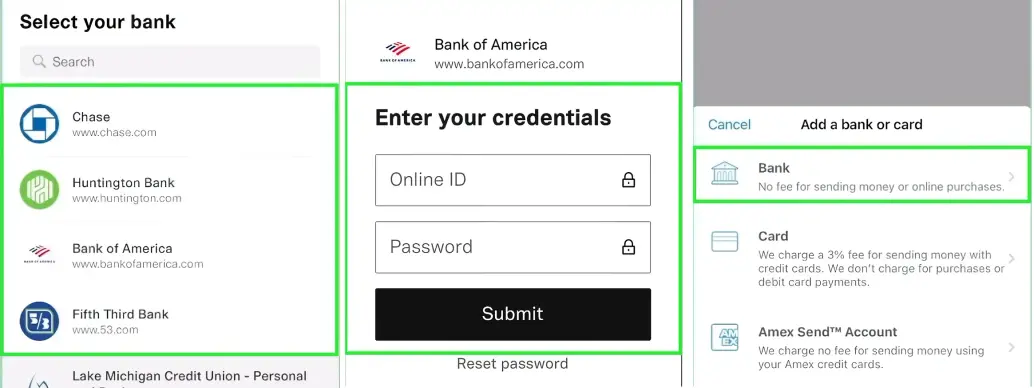

At this point, it should be clear that the key factor determining Venmo’s person-to-person limit for both sending and receiving is whether the user has a verified account. Therefore, the first thing you should do is complete the service’s identity verification procedure, which will also make your account more secure as a bonus. To do this, go to Settings and provide your name, date of birth, ID, social security number, and other required personal information.

Another method of getting approved for a higher Venmo limit is linking your bank account. This allows Venmo to access your account data and, as a result, increase your transaction limits based on your financial history and account balance. Please note that the service may require you to provide additional documentation before changing your account status.

Monitoring Your Venmo Limit

To avoid exceeding your transaction limit, you can:

- Monitor your Venmo usage by accessing your payment history;

- Verify your current sending and receiving money thresholds;

- Frequently check your remaining balance for each limit category.

You can go to your account settings at any time to review all transaction limits for your profile type. Once you're approved for a limit increase, all relevant information will be updated automatically.

If you are still unsure about using this payment system, getting a better idea of Venmo’s pros and cons will help you make an informed choice.

Conclusion

Venmo is a fast, secure, and convenient payment platform with advanced functionality, a simple interface, and low fees. However, before becoming a client of this payment system, you should understand the nuances of using the application, from account setup to Venmo’s daily limit. Remember, to get the most out of this service, you should verify your profile and link your bank account. These simple steps will allow you to avoid unpleasant surprises and increase your sending, receiving, and spending limits.