Venmo Scams: What You Need to Know and Do

Whether you've been using Venmo for years or just installed the app, you might wonder — can someone hack your Venmo account? Unfortunately, the answer is yes. With how popular the platform has become, Venmo scams are now more widespread than ever. Still, by following a few simple tips and staying aware, you can make life significantly harder for any fraudsters targeting your account. The best way to avoid getting your Venmo hacked is to transfer money only to people you know, but if things were that simple, there’d be no need for guides such as this one.

How does Venmo work in terms of security? The service goes an extra mile to protect its customers, but even the most sophisticated security protocols won’t be of much use if you voluntarily transfer the funds. With this in mind, let’s go over some common tricks scammers utilize to get money from unwary users.

Common Types of Venmo Scams

Can you get scammed on Venmo? Yes, absolutely. Can Venmo be hacked by sending money? It depends on your definition of “hacked”. While in most cases the scammers won’t get access to your account, the funds you’ve already transferred to them will be lost forever. Stay cautious! By the way, if you’re new to this and don’t know how to set up a Venmo account, be sure to read our article on the topic.

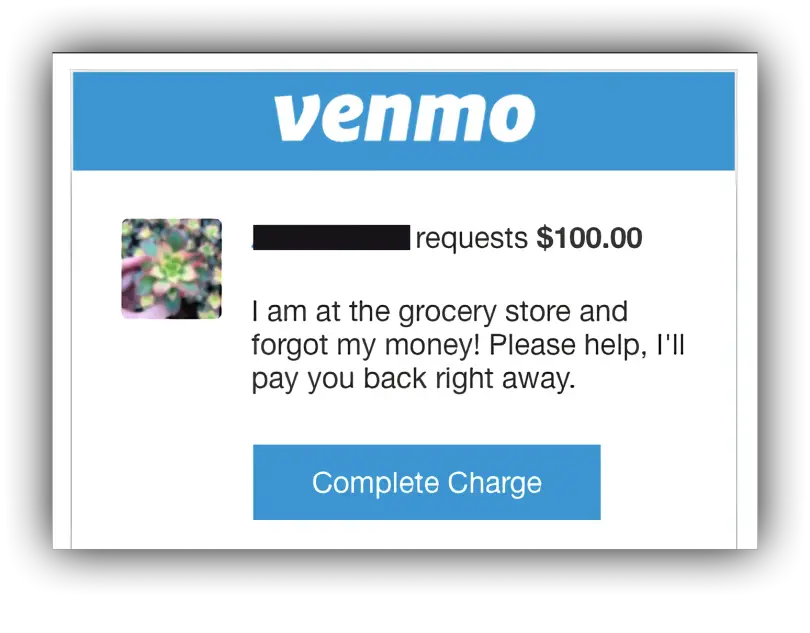

Requests from Fake Friends

Can people hack your Venmo by pretending to be someone you know? In fact, it’s probably the most common scam on the platform, as requests can be easily faked if a scammer gets hold of the personal data and profile picture of a user from your friend list. In this scam, a person posing as your friend or family member will be asked to urgently send money for an “emergency,” which can trick you into acting fast.

The easiest way to avoid this scam is to always verify any urgent requests via phone or another hard-to-fake communication channel. Also, make sure your transactions are set to private so your own data won’t get used against you. If the person asking for a transfer is indeed who they claim to be, you can go ahead and send the funds. Just remember to keep Venmo fees in mind!

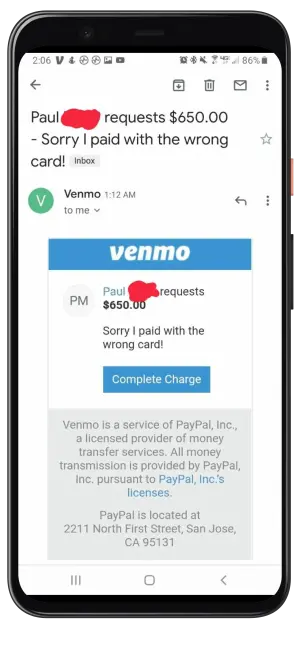

Mistaken Money Transfer Scam

So, we’ve talked about scams, but can Venmo be hacked? Actually, hacking the service will require skills far beyond what a typical fraudster can produce, so they rely on various technicalities. For example, a person may send you money, claim it was a mistake, and ask you to send it back to a different account. However, the initial transaction can be later marked as fraudulent and canceled, leaving you holding the bag.

To avoid scammers, simply ignore any suspicious requests from people you don’t know. You can also take a more proactive stance and report them as well.

If you’re feeling like your faith in humanity is slipping because of all of these scams, here’s a far more innocent article on how to add money on Venmo.

Customer Support Scam

In this scam, a scammer pretending to be a customer support agent will contact you and claim there’s an issue with your account. Then, they’ll ask you to provide some personal data to “fix” the problem. This method is especially popular among fraudsters who target elderly people, as they are usually less familiar with modern customer support procedures.

Remember that a Venmo customer support representative will never ask for a verification code. If you’ve encountered the one who does, hang up and report the incident to Venmo. If you’ve fallen for this trick and are wondering what to do if my Venmo account is hacked, contact the real customer support immediately through official channels. Always use two-factor authentication, and keep in mind that a legitimate customer support specialist will never try to get hold of your sensitive information.

Your account can get blocked for suspicious activity, even if you’ve done nothing wrong. Here are a couple of cases when your Venmo account might be suspended and what to do to resolve them.

If you’re curious about how much Venmo charges for business transactions or want to learn more about Venmo limits, we have separate materials on this topic on our website.

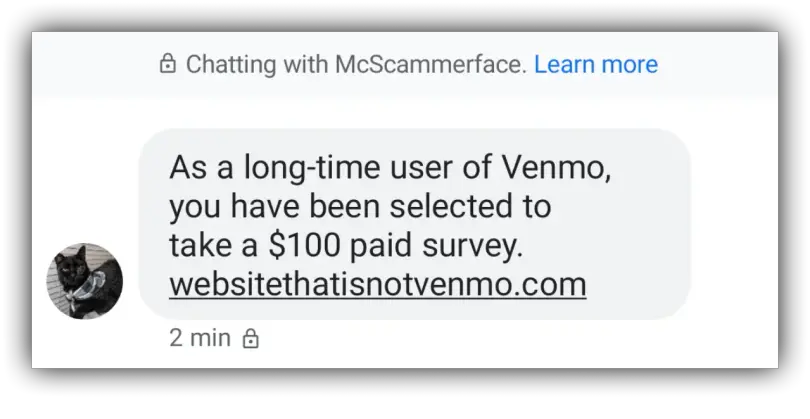

Giveaway or Prize Scams

Another Venmo scam you might come across is a message claiming you’ve won money or a prize. If you follow the link provided in the message, your device will be infected with malware, and your sensitive information, including passwords, might get stolen. Venmo’s email scams can also include requests for a small “fee” required to get the prize. Upon receiving the money, the scammer will block you and disappear.

To avoid this fraud, don’t click on any links from senders you don’t trust.

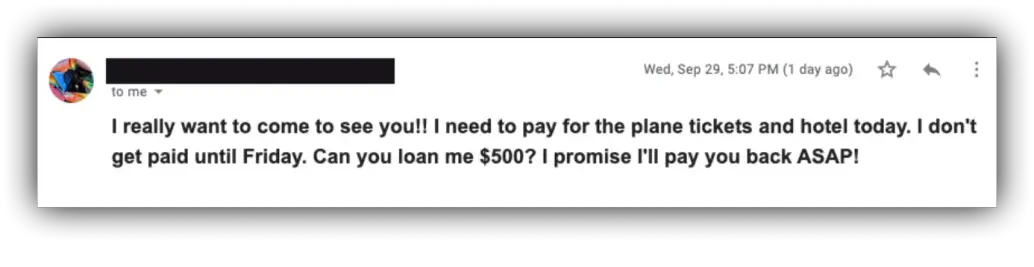

Romance Scams

Is Venmo safe to use with strangers? Not really. In a romance scam, a criminal builds a fake online relationship with the target. A scammer might use love-bombing and similar tactics to gain the target’s trust, and then ask for money while pretending to be in trouble. Once they receive the money, they vanish.

Avoid sending money to strangers, especially if the situation seems rushed or suspicious. This scam is by no means exclusive to Venmo, as the fraudster may as well ask you to use Zelle, PayPal, or any other payment service.

Fake Charity (Fundraiser Scams)

Scammers often create fake charity accounts in the wake of large-scale disasters or emergencies. They often share dreadful photos or stories to provoke strong emotions in their audience. They can even try to mimic a real charity organization by registering an account with a very similar name.

How to protect a Venmo account from such scams? Use this checklist before donating to charity:

- Check the spelling of the username. The subtle misspellings can be a sign of a fraudulent account.

- Check for the verified Charity Profile status. You can find verified organizations in the "Charities" tab of the Venmo app or on the platform’s website.

- Make sure the charity’s goals are stated clearly. If the profile doesn't fully explain where the money will go, doesn't provide links to the charity's official website, or simply doesn’t have any extra information, there's a good chance it's a scam.

- Never click on charity links in text messages. Instead, use the Venmo app or website to send donations.

Finally, always double-check the charity's official website and donate only to verified Venmo profiles.

Smishing Scams

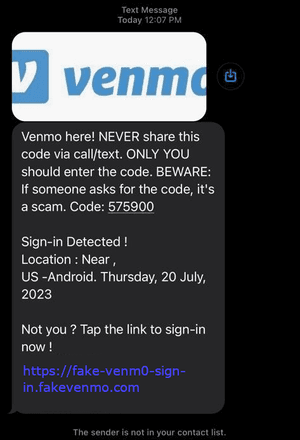

Venmo smishing is a scam where criminals send you a fake system message to get your sensitive data, make you download malicious software, or send money. Usually, such scammers will pretend to be Venmo support and try to trick you by manufacturing an issue that demands your immediate attention. The message will state something like “Account locked” or “Payment received,” with a malicious link that’ll steal your login credentials if you follow it. Criminals can also try to get a hold of a legitimate verification code sent to you by Venmo.

Always check whether the email or message was really sent by Venmo. Additionally, remember that when the service sends you an MFA/2FA code, the message will never include a link to click on.

Simple Tips to Protect Your Venmo Account

Can your Venmo get hacked if you use it with strangers? Not necessarily, but the risk is always there. Here are some steps you can take to safeguard your account:

- Make all your transactions private. How to make a Venmo account private? You’ll need to find the “privacy” tab in your account settings and set your default privacy to “private”. This simple change can go a long way in preventing scams.

- Use a strong, unique password. Aim for at least 12 characters with a mix of letters, numbers, and symbols. Alternatively, you can use a password manager that generates and stores strong passwords for you.

- Enable Multifactor Authentication (MFA or 2FA). Make sure you set up multifactor authentication to prevent Venmo fraud. It adds an extra layer of protection by notifying you of logins from unfamiliar devices.

- Regularly review linked devices and sessions. From time to time, open Venmo’s security settings and check the list of connected devices and active logins. Remove anything you don’t recognize and sign out of sessions you’re not using.

If you come across anything fraudulent, don’t hesitate to reach out to Venmo’s support team. For fake texts, snap a screenshot and send it to support@venmo.com. If you are dealing with an email scam, send it to phishing@venmo.com. You can also reach customer support at (855) 812-4430.

If you're trying to decide between PayPal and Venmo or comparing Venmo with Zelle or Cash App, we’ve put together a detailed comparison of these payment systems that might help you make up your mind!

Final Thought

In the world of online payments, scams are a constant threat. To keep your account safe, always double-check any transactions and messages you get before moving forward. If you ever spot something suspicious or have any concerns, don’t hesitate to reach out to customer support via email or phone. After all, responsive support is among the standout perks of Venmo.

FAQ

Is it safe to give someone your Venmo username and email?

Generally, a username or phone number isn’t enough to get access to your account. Still, phishing is a risk: scammers can find your account and send a message containing personal information to steal your credentials.

What should I do if I accidentally sent money to a scammer on Venmo?

Try to cancel the payment. If the scammer didn’t claim it yet, you’ll have your money back. Then, regardless of the outcome, report the fraud by contacting the customer support and providing all the details about the transaction.

How can I identify a fake Venmo message or request?

To maintain Venmo account security, look for red flags in text messages and emails, such as generic greetings, links to anything other than the official Venmo site, false sense of urgency, and a mismatched sender address. You should also stay away from strangers asking you to refund their "accidental" transactions.