Venmo to PayPal Transfers: A Full Guide

Contents

The popularity of both Venmo and PayPal is undeniable. A large percentage of people regularly use these popular peer-to-peer payment platforms to receive and send funds. While both services are owned by PayPal Holdings Inc. they operate as separate entities with distinct functionalities. Venmo is more focused on sending funds between friends and relatives, while PayPal is more diverse in its uses. For this reason, a common question arises—can Venmo send money to PayPal?

You may receive a sum of money from someone to your Venmo account, but you want to spend it using PayPal to benefit from a larger selection of features and access international payments. In this case, you should know the quickest and most convenient way to connect the two digital wallets. At the moment, there is no way to make a transfer from Venmo to PayPal directly. However, you can achieve this in a few steps by turning to your bank account. This is the most convenient and commonly used solution, so you can be sure that you take the easiest road.

In this article, you can find out more about the best solution for transferring funds to these payment services. We’ll explore the available methods, potential limitations, and steps you need to take to complete the transfer successfully. Whether you’re looking to consolidate funds or simply prefer using one platform over another, understanding how to transfer money from Venmo to PayPal can be invaluable for staying on top of your payment capabilities and financial options.

What is Venmo?

Venmo is a PayPal-owned digital wallet app that allows users to send and receive money via connected bank accounts using just an email address and a phone number. It’s ideal for peer-to-peer transactions between friends, family members, or anyone with a Venmo account. The system makes it easy to exchange money, whether it’s splitting a restaurant bill, reimbursing a friend for concert tickets, or paying rent. Users can divide expenses and request payments directly within the app. They can split payments evenly or customize the amounts based on each individual’s share, making group payments hassle-free.

What sets Venmo apart from other similar systems is its social features. Users can add emojis and comments to their transactions, adding a touch of personality to each payment. You can even gift wrap your payment for a special occasion to let the recipient see a special animation when opening it.

What is PayPal?

PayPal is a platform for digital money transfers designed for both individuals and businesses. You can add money to a PayPal account using a credit card or a bank account.

Founded in 1998, PayPal has grown to become one of the world’s largest and most widely used payment processors, facilitating millions of transactions daily across borders and currencies. It provides a safe and efficient way to manage money online, be it sending money to a friend, shopping online, or accepting payments for goods and services.

PayPal’s distinguishing feature is its robust solutions for businesses, including payment processing, invoicing, and checkout integration. Using PayPal’s suite of tools and services, organizations can conveniently accept payments from customers globally and streamline their financial operations.

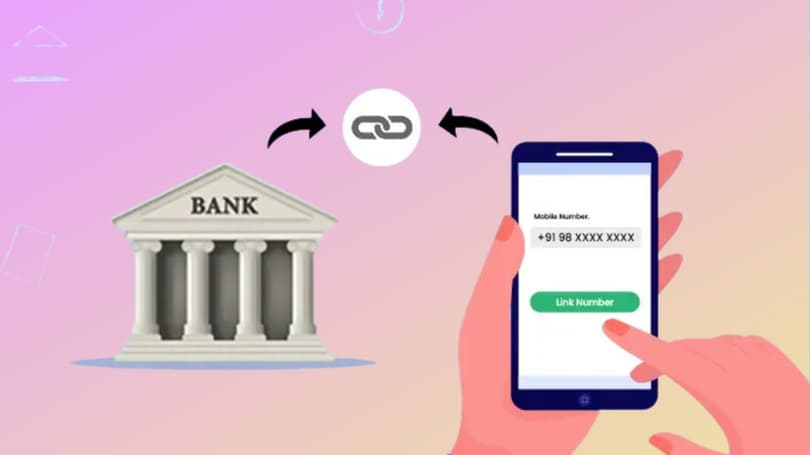

Linking Your Venmo and PayPal Accounts via Your Bank Account

How can I send money from Venmo to PayPal? Even though both payment services are commonly used, not all users know exactly how to transfer their Venmo balance to PayPal. There is no integration between these wallets, meaning you cannot send money directly. Luckily, there is a quick solution that requires only a few steps.

Link your Venmo account to your bank account

So, how can you send money from Venmo to PayPal? Let’s start by linking your Venmo account to your existing bank account. This process is quick, as all you should do is:

- Log in to your Venmo account.

- Open Settings and then choose Payment Methods.

- Go to Add bank or card and select Bank from the options.

- Choose the verification method — either the manual one or the Plaid integration option.

The Plaid integration is useful for moments when you are in a rush, as it is performed instantly.

Link your PayPal account to your bank account

The next thing you should do is go to your PayPal account and link it to your bank account:

- In your PayPal account, you should select Add card or bank.

- Another way is to select Wallet from the menu at the top and then select Link a card or bank.

- You should then provide your banking details, and you will be asked to make two small deposits.

During this step, it is important that you enter the exact same bank details for both your PayPal and Venmo accounts.

Transfer funds to your bank account from Venmo

At this stage, you may wonder how to transfer your Venmo balance to PayPal after linking accounts to a bank. There is not much left to do! You can now start sending money from your Venmo account to the bank account you have connected to it.

In your Venmo account, you have two transfer options to choose from. You can go for an Instant option and receive your money immediately. But, you should remember that instant transactions envisage a 1.75% fee. If you prefer not to overpay, you can choose Standard transfer, which takes 1–3 business days, and money will be added without any fees. This will be especially useful and noticeable if you send large sums.

Receive money from your bank account to PayPal

The final step is to send the balance from your bank account to PayPal. The way it works is:

- Select Transfer Money in your PayPal account.

- Choose Add money to your balance and choose a bank account connected to Venmo.

- You can then enter the required sum and choose Add, and your money will appear in your PayPal account.

This is your solution for the problem of how to transfer money from Venmo to a PayPal account. Although both services experience a lack of integration between them, sending your funds remains simple and quick.

Transferring Funds from Venmo to PayPal: What You Should Know

Sending funds in the mentioned way is simple, and you can complete the entire process in no time. Now that you know the answer to “Can you transfer money from Venmo to a PayPal account?” is positive, there are also a few things you have to consider.

Be aware of cross-currency transfer

One of the first things you should know about when sending your funds from Venmo to PayPal is currency exchange fees. If you want to perform a cross-currency transaction, you must know that this can be fairly expensive. The conversion will happen in your PayPal account, so you will have to pay a currency exchange fee. Additional fees may also apply for cross-border transfers.

Consider Instant Transfer fees

If you are not in a rush and want to avoid fees, you should stick to the Standard Transfer offered by Venmo. You’ll receive your money in your bank account in 1–3 business days. When you choose Instant Transfer, you will see funds in your account in several minutes but will pay a 1.75% fee.

Keep the same name for your services

Another recommendation that can make your life easier in different situations is to have the same name in your bank account and your PayPal and Venmo accounts. This ensures the unproblematic transfer of funds between the accounts, and you can be confident that you meet any regulatory requirements.

Keep the accounts linked for a quick transfer of funds

It is a good idea to keep your PayPal and Venmo accounts connected, so you can transfer money whenever you need without having to verify your bank account again by making deposits.

Now, there is no need to ask your friends or google how to connect Venmo to PayPal, as all the information you need is in this article. With the recommendations mentioned above, you can enjoy the convenience and ease of this transfer option.

Conclusion

Can you transfer from Venmo to PayPal without any issues or overwhelming steps? Absolutely! Now, you no longer have to wonder how to complete a transfer from Venmo to PayPal. The entire process is extremely straightforward. You should just have both payment services and a single bank account.

You can easily send money from Venmo to a PayPal account whenever you need to get a whole bunch of opportunities for online shopping and be able to make payments in different currencies with PayPal. By linking these two popular payment services, you’ll embrace the best of both worlds.

FAQ

How do I transfer money from Venmo to PayPal without fees?

There are no fees associated with sending or receiving money while using Venmo. The same goes for receiving funds from your bank account to PayPal. However, a 1.75% fee is always applied to the Venmo Instant Transfer to Paypal option, and a 5% fee is charged for currency conversion. To avoid them, you should stick to a Standard Transfer that takes 1–3 days and use the same currency.

Are there alternatives to Venmo-to-PayPal transfers other than through a bank account?

When it comes to Venmo-to-PayPal transfers, the best option is having a single linked bank account, as by using other alternatives, such as third-party services, you will have to pay fees.

Can I reverse a Venmo to PayPal transfer?

It is impossible to transfer Venmo money to PayPal directly. If you send money from Venmo to your bank account (or from it to your PayPal account) by accident, you can simply send it back. You can also contact customer support to reverse this payment.

Can I transfer money from PayPal to Venmo directly and without additional steps?

No. It is impossible to simply link the two services, as no direct integration is available. The solution is to have a single bank account for both services and use it as a transitional platform for your money.

How do I transfer money from Venmo to PayPal without a bank account?

If you wonder how to transfer funds from Venmo to PayPal without using a bank account, you can incorporate an additional service. Some options are TransferWire and Xoom. It is recommended to always check potential fees, as they can differ depending on the payment service provider.