Venmo Account: What It Is and How It Works

Contents

In today's digital age, where convenience and speed are paramount, Venmo has emerged as a leading solution for seamless money transactions. Sharing bills with friends, paying rent to your landlord, or buying coffee from your favorite café is a breeze with this mobile payment service, offering a convenient and hassle-free way to handle financial transactions.

Founded in 2009 and acquired by PayPal in 2013, Venmo has rapidly gained popularity, particularly among younger generations, for its user-friendly interface and social networking features. In 2023, the pool of active users hit the 80 million mark in the US, making it one of the most popular payment platforms.

In this guide, we will explore the questions, what is Venmo and how it works. Keep reading and learn about its benefits, security measures, and how to ensure safe and effective transactions. Join us as we delve into the world of Venmo and discover how it can simplify your financial interactions.

What is Venmo?

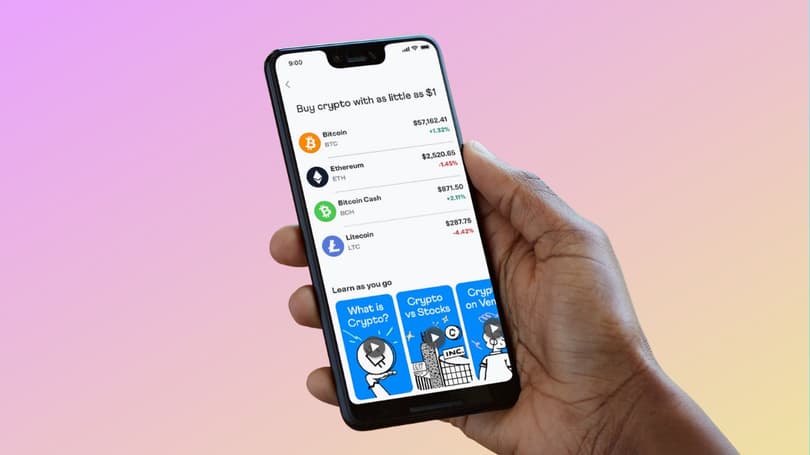

Venmo: what is it, and how does it work? It is a mobile app for online payments and money transfers that makes the whole process easy and secure. First, you need to understand how to set up a Venmo account to start working with it. It is designed to be used by family members and close groups of friends, and for that purpose, it offers such features as splitting bills, transaction tracking, and even emoticons.

Moreover, Venmo offers additional features such as Venmo Debit Card, enabling users to spend their Venmo balance in-store and online at merchants that accept Mastercard. The platform also supports instant transfers to linked bank accounts for a small fee, providing users with maximum flexibility when managing their finances.

Now, what about the benefits of using Venmo? Here is the list of them:

- Convenience: The service has a seamless and user-friendly interface, which makes sending and receiving money effortless.

- Instant Transfers of Money: Users can quickly access the funds in their payment service balance or linked bank account to conduct different financial transactions immediately.

- Speed: Quick transfers and instant access to funds allow users to make payments or receive them swiftly.

- Social Interaction: The app pays special attention to user engagement and adds some fun for users to stay connected with friends and share their payment experiences.

- Expense Management: The transaction tracking feature helps users monitor their spending, making it easier to manage personal finances and budgets effectively.

- Security: The service ensures the security of every transaction and protects users' financial information to ensure peace of mind when using the platform.

The full list of pros and cons of Venmo will also be of interest to users of the payment system.

Setting Up Your Venmo Account

So, Venmo: how does it work? Actually, there is nothing complicated about using Venmo. Let’s figure it out.

Download and Install the Venmo App

- Head to your device's app store (App Store for iOS or Google Play Store for Android).

- Search for "Venmo" and select the official app.

- Click the "Install" or "Get" button and wait for it to download and install.

Create a Venmo Account

- Open the app on your device.

- Tap on "Sign Up" if you need to create a new account.

- You can sign up using your email address or phone number. Follow the instructions to finish setting up an account.

If you are already a user of the payment system and have not used your account for a long time, you may be wondering how to unfreeze Venmo account and continue to use all the functions to the fullest.

How do Venmo payments work?

- After creating your Venmo account, the next step is to link a preferable payment method.

- Tap on the menu icon in the app.

- Select "Settings" and then "Payment Methods."

- Now link your preferred payment method to your Venmo account (your credit or debit card or a bank account).

What type of account is Venmo allowing you to create? When setting up an account, you can choose Personal or Business. The latter is mostly used for receiving payments for goods and services and involves higher fees for peer-to-peer transactions. For the Venmo for business fees also differ from personal ones.

What is a Venmo account, and how does it work?

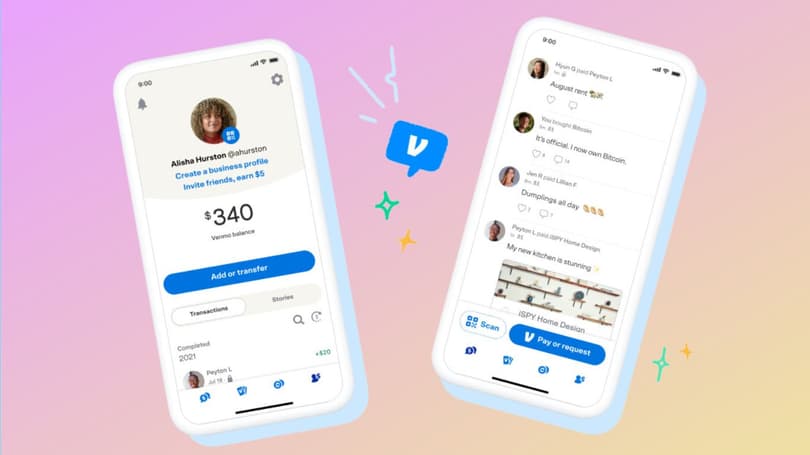

A Venmo account is a digital wallet that allows one to send, receive, and manage money through a mobile app. How does a Venmo account work? It connects a user’s bank account, credit card, or debit card to their e-wallet, enabling users to conduct different financial operations through the app, and gives an understanding of how to add money to Venmo and how to manage it.

Sending and Receiving Payments

How does paying with Venmo work? This service can make your personal financial operations effortless. Simply enter the recipient's username, phone number, or email address, along with the payment amount and a brief description. You can easily settle debts, split expenses, or pay friends back.

Splitting Bills and Group Payments

The app makes it convenient to split bills among friends or make group payments. Whether you're paying for dinner, rent, or a gift, Venmo ensures a hassle-free and fair division of expenses for multiple users.

Venmo Security and Privacy

Firstly, users are interested in weather can Venmo be hacked and how to deal with it. A strong emphasis on security and privacy means that your personal data and financial information are protected through encryption and security protocols. Additionally, you can configure your account visibility, allowing or restricting certain users to see your transaction info.

Venmo Fees and Limits

Now that you know what is Venmo used for, to ensure a smooth and transparent experience, you should know about the Venmo fees, transaction limits, and account confirmations. Here's a brief overview:

Transaction Fees

It is free to use your linked bank account or debit card to send money through Venmo. However, the service charges fees for:

- using a credit card for payments — 3%;

- instant payments to a bank account or debit card — 1.75% (min — $0.25; max — $25);

- receiving money for goods — 1.9% plus a flat fee of 10 cents.

Transaction Limits

In order to ensure security, there are certain Venmo transfer limit to the amount of money users can send within a certain timeframe. That is, for unverified accounts, the weekly limit is $299.99, and if you complete your verification, it increases to $60,000. There is also a weekly limitation of $7,000 for purchases.

Account Confirmations

The mobile payment service requires users to confirm their accounts to prevent unauthorized use. During this process, you may be asked to verify your email address, phone number, or bank account. Account confirmation may benefit you since it results in an increase in spending limits and additional account security measures.

To understand what is the best choice in comparison to other popular payment systems, such as Venmo or PayPal, you need to learn more about the advantages and disadvantages of each. We also have a comparison of Cash App vs Venmo and Zelle vs Venmo on our website, where you will definitely find the most suitable payment system for yourself.

Conclusion

Venmo is a user-friendly mobile payment app that offers convenient and secure transactions for users to send and receive money digitally. This service is a perfect choice for a family or a group of friends since it allows splitting the bills and making instant money transfers effortlessly.

Now that you understand Venmo and how it works, follow these tips to ensure safe and effective transactions:

- Set up strong and unique passwords for your Venmo account and enable multifactor authentication for an extra layer of security.

- Double-check the usernames, phone numbers, or email addresses of recipients before making a payment.

- Choose the level of visibility by adjusting your settings. Only you decide who can see your transactions.

- Regularly review Venmo's credit card spending limits and fees to avoid unnecessary expenses.

- Do not share sensitive information publicly when using Venmo's social features.

FAQ

How does Venmo work, and is it safe?

Venmo is an app for peer-to-peer transactions, payments for goods, and money transfers. All you need is to enter the recipient's details and the payment amount. Venmo employs encryption, compliance with all regulatory documents, and other security measures to protect the information and sensitive data of its users. Using Venmo for online payments is as safe as it can get.

Does Venmo work internationally?

Unfortunately, no. Moreover, to send or receive payments using Venmo, both participants should have US bank accounts and, in some cases, even provide social security numbers.