What is Cash App and How Does it Work?: What You Need to Know

Sending and receiving money using mobile devices has become the norm thanks to an abundance of digital wallets. One of the most prominent players among peer-to-peer payment applications is Cash App. It allows you to conveniently perform transactions, manage your finances, and even invest. What’s great about the app is that it doesn’t charge any fees for sending or receiving money to personal accounts.

In this article, you will find out how the app works, what features it provides, and how to set up your account. Keep on reading to see what Cash App has to offer.

CASH APP AND HOW DOES IT WORK?

Cash App—what is it? Cash App is a P2P payment service designed for sending and receiving payments via mobile devices. This platform also allows users to invest money in Bitcoin or stocks.

Now that you know the basic definition, you probably wonder—what does Cash App do in terms of features? It is worth noting that Cash App provides an extensive number of services, making it so attractive to users.

WHAT IS CASH APP USED FOR?

Cash App stands out from some less popular apps with its extensive selection of features. While you can use it just to send and receive money, it offers more exciting functions from which you can benefit. These include but are not limited to, investing and saving money conveniently. Here are the main ways you can use Cash App in more detail.

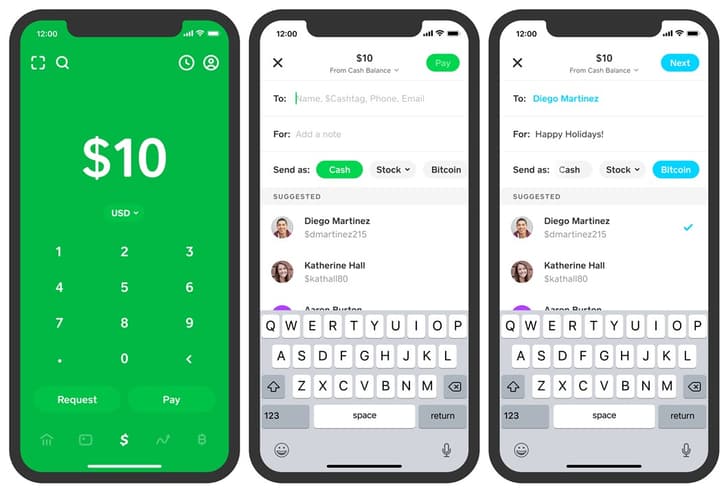

Accepting and sending money

What is Cash App for? The number one use of this platform is to send and receive funds quickly. So, let's find out how to send money on Cash App and how to use it. To do this, you need to link your current bank account to the app. Every user that creates a Cash App account has their personal $Cashtag, which is a username for individuals to find one another on the platform.

Transferring funds to a linked bank account

Users can choose whether to keep the money they receive on their Cash App balance or send funds to their linked bank accounts. The app offers standard and instant transfers. With the standard option, the money transfer is completed in 1–3 business days. For instant transfers, you have to pay a fee of 0.5%–1.75% of the amount ($0.25 is a minimum fee). It is worth noting that each transaction and service has its own Cash App fees determined by the payment system.

Investments

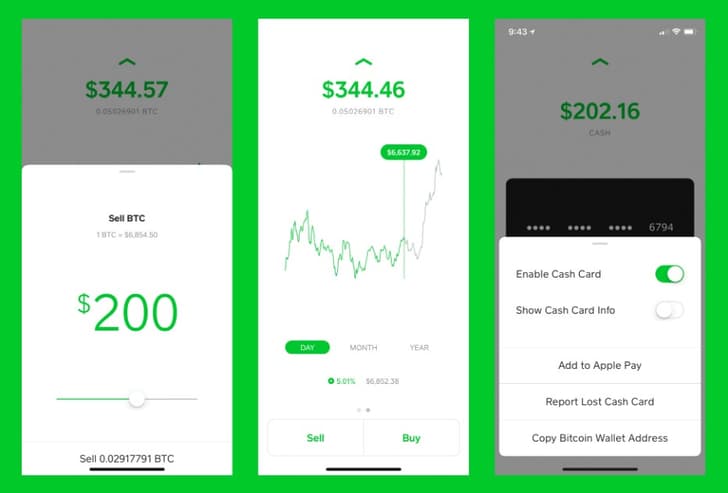

This section won’t be complete without talking about investing. With the help of the application, you can sell, buy, and hold both Bitcoin and stocks. While you won’t find an impressive range of investment features in such a simple app, it can still be a great entry point for those interested in investing money.

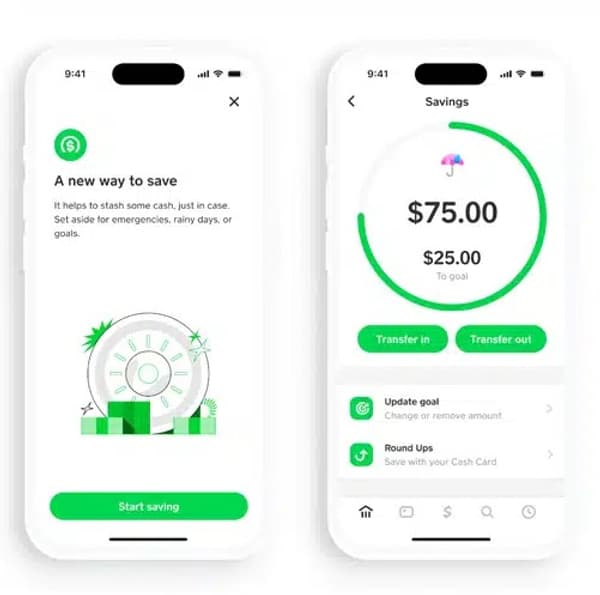

Saving money in the app

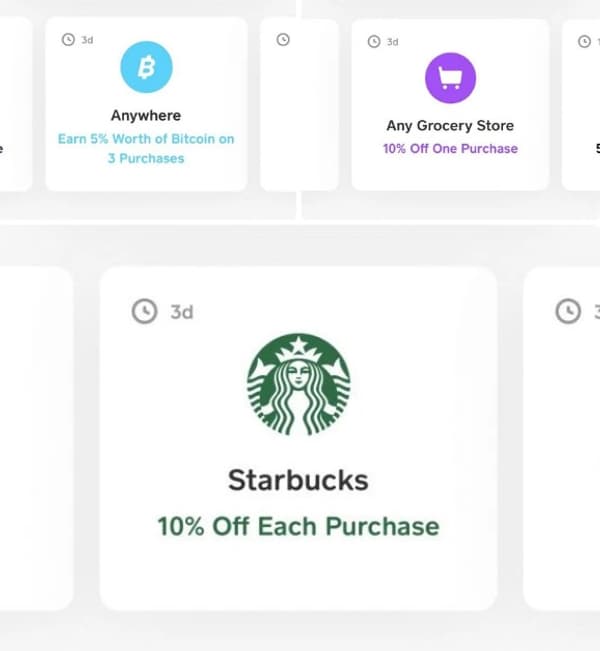

The application allows users to put money aside using their accounts. By using the Money tab, you can configure specific savings goals. You can either use money directly from your balance or a payment service linked to it. While you don’t earn interest, it is still a convenient way to save up some money. The system also offers other promotions and bonuses, such as Cash App Boost, which provides discounts using a debit card.

These are the basic features of the application, but it also offers additional opportunities.

Cash App Account Setup and Its Opportunities

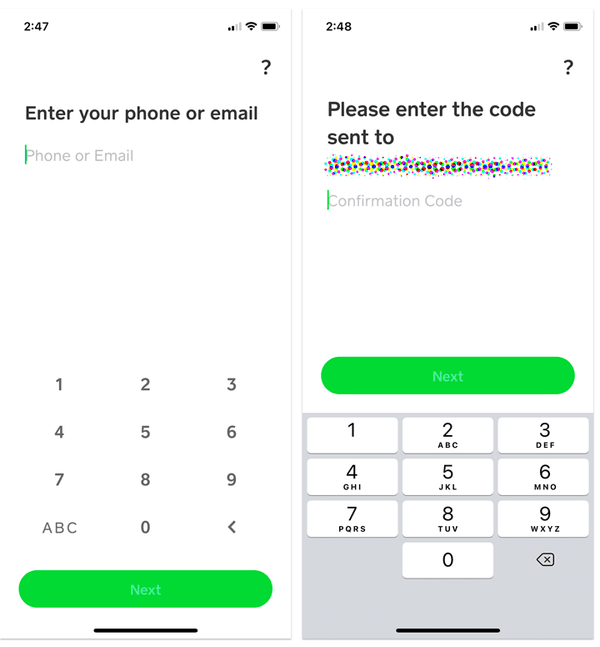

What is a Cash App account, and what is the easiest way to create one? Luckily, there are no special steps for you to take. Setting up a Cash App account is a straightforward process:

- Download Cash App for your iOS or Android smartphone.

- Enter your email login ID or phone number to continue and complete the verification process.

- Next, you need to link your existing bank account to the application during the setup.

- Then, you will be asked to create a unique $Cashtag username. It must include at least one letter and be no more than 20 characters long.

After completing all these steps, your account can be used to send and receive money. The developers have also provided a range of additional features.

Cash Card and Cash App Boosts

Another feature that makes this financial platform stand out is that a user has an opportunity to request a Cash Card. It is a debit card certified by Visa, so you can use it online, at ATMs to withdraw cash, or for payments in offline stores. If you are wondering whether you can add a Cash App prepaid card, only other prepaid cards can be added to the system.

What is more, users with Cash Cards get access to cashback. This feature offered by the Cash App is referred to as Boosts. When you pay for some services and goods at various stores (Whole Foods, Walmart, etc.) and restaurants, you get a certain cashback.

Managing your Bitcoin

What is a Cash App purchase opportunity when it comes to Bitcoin? One of the unique features of Cash App is the opportunity to send, buy, and sell Bitcoin whenever you want. You can do this by using your Cash Card or your Cash App balance, so it’s an easy way to manage any of your Bitcoin investments.

Investing and buying stocks

Investing is a feature that you won’t find in many digital wallets. With Cash App, users can invest in stocks and can begin by spending just $1. The app allows users to buy a portion of a certain stock, so everyone can start their investment journey.

If for some reason you don't like the app or won't use it anymore, you should know how to delete Cash App account to resolve this issue.

Conclusion

Now you have the answer to the question of “What is Cash App, and how does it work?” and it’s obvious why so many people choose this service. The Cash App platform allows you to quickly send and receive funds, save money, and transfer them to your bank account. You can request a Cash Card and thus make payments offline in a convenient way. With the app, you can start investing in Bitcoin or stocks and get all the features you need for this.