How to Budget for Your Needs, Wants, and Goals

Budgeting for needs and other expenses allows you to have a clear idea of how much you earn and spend on a day-to-day basis. When you take your budget seriously, you can be more sure you will always have enough money for your wants/needs/savings. By using budgeting strategies, you can plan with more confidence for the future and save for big purchases.

In this article, you can learn about effective budgeting methods, how to track your spending, and principles that are crucial for achieving your financial goals.

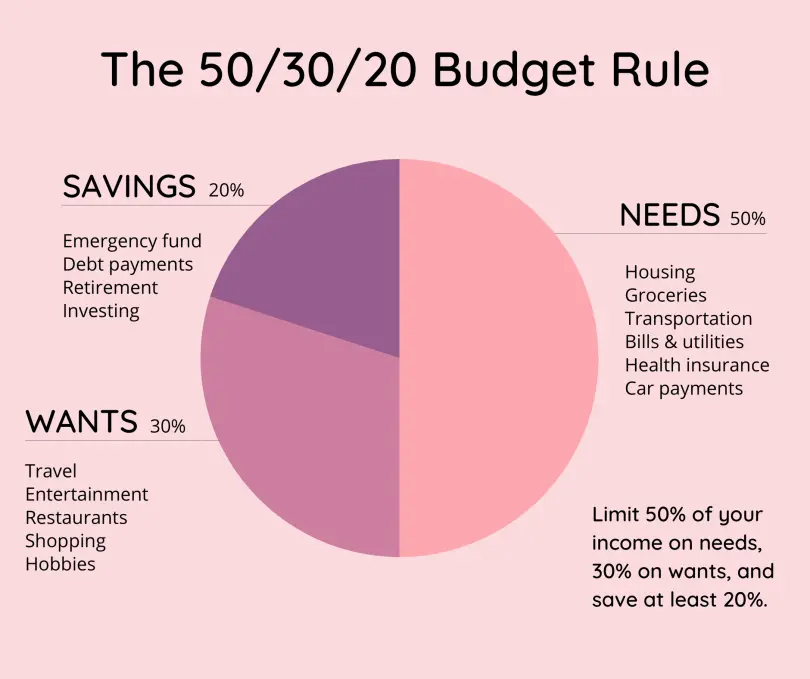

Maximizing Your Finances with the 50/30/20 Budget Method

When you are just learning how to budget money, you may not know what approach to take and how much you should strive to save. The 50/30/20 is a useful rule for needs/wants/savings that you can apply to your monthly budget to keep your expenses under control.

According to the 50/30/20 budget method, 50% of your income should cover your needs, 30% should go towards your wants, and 20% has to be saved towards your future goals. This is a general rule, as some people may spend less than 50% of their income on needs, so they can put more towards savings.

Needs

Just as the name suggests, needs refer to non-negotiables, such as food, healthcare, utility bills, loans, minimum credit card payments, mortgage payments, and such. You should not include any spontaneous purchases or other expenses you can live without in this category. If your needs cost you more than 50% of your income, you have to make some adjustments.

Wants

This 30% category includes expenses that make your life better, but you can live without them. Some examples include vacations, dinners at restaurants, entertainment-related subscriptions, hobby supplies, and so on.

Goals

Saving enough money is an important step in making a budget work for your future. You should strive to save at least 20% towards your future goals. Options include saving money to make a down payment on a house or putting your funds in an emergency fund.

Therefore, if you wonder, “What is the best way to create a budget?” — the 50/30/20 rule is a great starting point for most situations.

Track Your Spendings and Avoid Unnecessary Expenses

So, where do you begin with budgeting when you are just starting out? After you write down your income, the first thing you should do is track your expenses.

It is a good idea to study your expenses for one or two months to see exactly how much you spend. The list should include not only large purchases but also minor ones, such as a cup of coffee on the way to work. By the end of the month, you may be surprised how much such small expenses add up.

You can either write your expenses on paper, use online spreadsheets, or go for a more modern approach, such as a budgeting app. Some of the popular options for managing personal finances include Mint, NerdWallet, and You Need a Budget. These apps differ in their features, but all of them help you track your expenses more easily.

If you have issues avoiding impulse purchases, there are ways to approach the problem mindfully. For example, you can try to write a list of items you have to buy before you go shopping and stick only to it.

To prevent unnecessary online shopping, you can start by making it less convenient to buy something spontaneously. This can be done by deleting your shopping apps and credit card information from websites, so you cannot make a purchase in just one click.

Use the SMART Principle to Achieve Your Financial Goals

The answer to how to save and budget money is to have a plan and stick to it. It’s difficult to save money just for the sake of it, so it’s better to have more concrete goals. For this, you can use the SMART goal-setting principle that stands for:

Specific

You should be specific about why you budget and what you want to achieve by reducing unnecessary expenses.

Measurable

Your final goal shouldn't be an abstract one, like "having enough money to live happily." Instead, stick to simpler and measurable objectives, for example, pay out the debt or make a down payment for the house.

Attainable

Your financial goals must be reasonable. You shouldn’t try to save more money at the expense of your needs, as this will only negatively impact your future.

Relevant

Your budget should not conflict with your current lifestyle or your goals. For instance, if you need to pay out a debt, it may not be a good idea to start saving up for a big purchase.

Time-bound

Your budgeting goals should be time-bound. For most people, it’s easiest to assess the progress every month. For instance, if you are saving up for a car, you have to calculate how much money you need to put aside every month and for how long.

Final Thought

Most people want financial freedom, and understanding how you spend your money is part of the process. With proper budgeting, you won’t unexpectedly run out of money by the end of the month. Having a budget that you stick to helps you prevent overspending, allows you to cover your needs and wants, and ensures you have savings for emergencies.