How to Budget for Your Needs, Wants, and Goals

Creating a budget that works for you and helps you save for the future is always a great idea. When you don’t track your expenses, it’s easy to get carried away, especially when using a credit card. Nonetheless, with careful management of your money, you can both enjoy your life in the moment and secure your future.

If you want to learn how to budget, this article provides you with simple principles to help you keep track of your income, reduce impulse expenses, and set financial goals.

Apply the 50/30/20 Rule to Managing Your Income

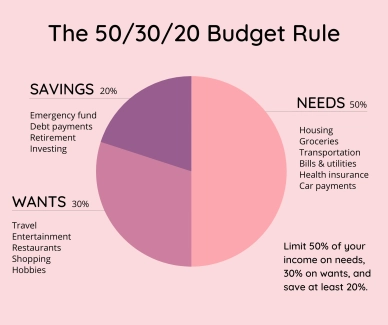

When you are just learning how to budget money, you may not know what approach to take and how much you should strive to save. The 50/30/20 is a useful rule that you can apply to your monthly budget to keep your expenses under control.

According to the 50/30/20 rule, 50% of your income should cover your needs, 30% should go towards your wants, and 20% has to be saved towards your future goals. This is a general rule, as some people may spend less than 50% of their income on needs, so they can put more towards savings.

Needs

Just as the name suggests, needs refer to non-negotiables, such as food, healthcare, utility bills, loans, minimum credit card payments, mortgage payments, and such. You should not include any spontaneous purchases or other expenses you can live without in this category. If your needs cost you more than 50% of your income, you have to make some adjustments.

Wants

This 30% category in how to budget your money includes expenses that make your life better, but you can live without them. Some of the examples include vacations, dinners at restaurants, entertainment-related subscriptions, hobby supplies, and so on.

Goals

Making sure you save enough money is an important step in how to make a budget work for your future. You should strive to save at least 20% towards your future goals. The options include saving money to make a down payment on a house in the future, or putting your funds in an emergency fund.

Therefore, if you wonder, “What is the best way to create a budget?” — the 50/30/20 rule is a great starting point for most situations.

Track Your Spendings and Avoid Unnecessary Expenses

So, where do you begin, and how do you make a budget when you are just starting out? The first thing you should do after you write down your income is track your expenses.

It is a good idea to study your expenses for one or two months to see exactly how much you spend. The list should include not only large purchases but also minor ones, such as a cup of coffee on the way to work. By the end of the month, you may be surprised how much such small expenses add up.

You can either write your expenses on paper, use online spreadsheets, or go for a more modern approach, such as a budgeting app. Some of the popular options for managing personal finances include Mint, NerdWallet, and You Need a Budget. These apps differ in their features, but all of them help you track your expenses more easily.

If you have issues avoiding impulse purchases, there are ways to approach the problem mindfully. For example, you can try to write a list of items you have to buy before you go shopping and stick only to it.

To prevent unnecessary online shopping, you can start by making it less convenient to buy something spontaneously. This can be done by deleting your shopping apps and credit card information from websites, so you cannot make a purchase in just one click.

Use the SMART Principle to Achieve Your Financial Goals

The answer to how to save and budget money is to have a plan and stick to it. It’s difficult to save money just for the sake of it, so it’s better to have more concrete goals. For this, you can use the SMART goal-setting principle that stands for the following:

Specific

You should be specific about why you budget and what you want to achieve by reducing unnecessary expenses.

Measurable

At the end of each month, you have to assess how much money you have spent and how much you want to spend the next month.

Attainable

Your financial goals have to be reasonable. You shouldn’t try to save more money at the expense of your needs, as this will only have a negative impact on your future.

Relevant

Your budget should not conflict with your current lifestyle or your goals. For instance, if you need to pay out a debt, it may not be a good idea to start saving up for a big purchase.

Time-bound

Your budgeting goals should be time-bound. For most people, it’s easiest to assess the progress every month. For instance, if you are saving up for a car, you have to calculate how much money you need to put aside every month and for how long.

Final Thought

Most people want financial freedom, and understanding how you spend your money is part of the process. With proper budgeting, you won’t unexpectedly run out of money by the end of the month. Having a budget that you stick to helps you prevent overspending, allows you to cover your needs and wants, and ensures you have savings for emergencies.

Tracking your monthly income shouldn’t be overwhelming, as you can start by simply writing down your income and expenses. Even these small changes can make a world of difference in your finances.

FAQ

What is a budget, and why is it needed?

A budget shows how much money you earn and how you spend it. You can use a budget to decide how much you want to save and how much to spend every month. The goal of having a well-managed budget is to make sure you have enough money for your needs and your future.

How do I calculate my income and expenses?

The first thing to do when making a budget is to ensure that you are aware of your income and expenses. The easiest solution is to have two separate lists — how much you earn and how much you spend. At the end of the month, you should subtract your expenses from your income.

How do I track my expenses and control my budget?

The most important part of learning how to create a budget is to track your expenses. You can calculate your spending by entering everything you buy in a spreadsheet or a specialized app, such as Mint or PocketGuard.