Budget App Review: The Best Apps for Your Personal Finance Needs

Household budgeting is a nice habit to have. Yet, managing personal finances can be a complex and often overwhelming task for most of us. With the right tools at hand, though, you can improve the situation. Effective tools like budgeting apps can help us efficiently organize finances by keeping track of our income, expenses, savings, and investments.

In this article, you’ll find a comprehensive review of some of the best budgeting apps on the market, offering insights into their features, usability, and overall value. Whether you're looking for intuitive expense tracking, investment management, or simply a way to create a realistic budget, you’ll get helpful guidance here.

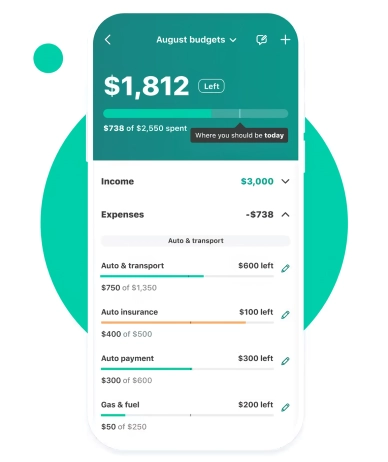

Mint: The Best Budget Tracking App to Monitor Daily Finances

Mint is a comprehensive personal finance app for those who seek to stay on top of their day-to-day financial activity.

Mint allows users to keep an eye on their expenses by linking their bank accounts, credit cards, and other financial accounts. At the same time, the app will use an automated interface to categorize transactions, giving a clear breakdown of where money is being spent. The categorization feature is great for identifying areas where users may be overspending. For example, you might realize you're spending more on dining out than you thought, prompting you to make adjustments to your budget.

To improve finances and grow their budgeting skills, users can set up personalized budget limits based on income, expenses, and financial goals. The app provides real-time updates on spending against those limits, sending alerts when nearing predefined thresholds;

On top of its budgeting functions, Mint offers a feature that enables users to monitor their credit scores and receive personalized tips with “Mintsights” for enhancing those financial ratings.

Pros | Cons |

|---|---|

|

|

Mint is an excellent budget tracker app, but lags behind in long-term planning capabilities. As such, it’s good for those who want to customize their budgets on the go rather than plan ahead.

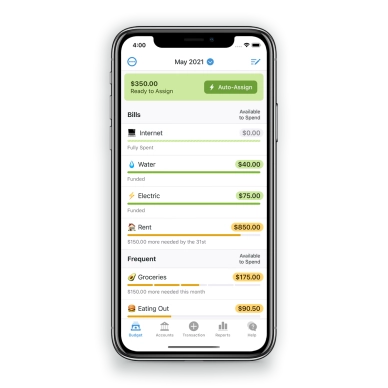

YNAB: The Best Budget App for Goal Setters

YNAB (You Need a Budget) is a powerful budgeting app designed to help users take control of their finances and achieve their financial goals. It sticks to a zero-based budgeting approach, requiring users to allocate every dollar to specific categories, ensuring that all income is accounted for.

Emphasizing goal-setting, the app enables users to track progress towards various financial objectives, such as saving for emergencies, debt repayment, or vacation funds. If a user is striving to build an emergency fund, YNAB will let them allocate a portion of their income each month toward this fund. The app will track their progress, helping users to stay motivated.

On top of that, a specialized debt control tool helps strategically pay down debts, providing insights and recommendations on how to allocate funds effectively.

To give users a comprehensive understanding of their financial habits, YNAB provides detailed reports and visualizations, enabling them to make more informed decisions.

Pros | Cons |

|---|---|

|

|

If you seek a budget app to bring your finance planning skills to a new quality level and improve finances in the long run, YNAB is for you.

Empower Personal Wealth: The Best Budget App for Investing Needs

As the name suggests, this tool is tailored for users striving to invest effectively. The app provides detailed insights into investment portfolios so that you can monitor performance, analyze holdings, and make strategic decisions on your portfolio optimization. Thus, if you are looking to diversify your investment channels, Empower Personal Wealth can provide insights into your current holdings, helping you make informed decisions about where to allocate your funds more effectively.

Empower can track user spending and create budgets to ensure that they are aligning their financial habits with their investment goals. Bill tracking and payment reminders to help you stay on top of your financial obligations, avoiding late fees and penalties. And a high-yield checking account will let you earn competitive interest rates on your savings.

Pros | Cons |

|---|---|

|

|

Empower is a functional and efficient financial analyzer and investment tool. Yet, if you rather need a planner with more sophisticated budgeting capabilities, consider other alternatives.

Goodbudget: The Best Tool for Smart Budgeting

Goodbudget replicates the traditional envelope system, where users allocate specific amounts of money to virtual envelopes representing different spending categories. This method encourages mindful spending. Suppose you allocate a specific budget for groceries. Using Goodbudget's envelope system, you can physically allocate cash or digitally set aside a designated amount for groceries. This visual representation will encourage you to stick to your budget while shopping.

The app is also suitable for households or couples, as it allows multiple users to access and manage shared budgets via an automated interface, ensuring transparency and collaborative financial planning.

While not as extensive as specialized debt management apps, Goodbudget includes basic tools for tracking and managing debt payments.

Pros | Cons |

|---|---|

|

|

Goodbudget is one of the best budget apps, employing the popular envelope visualization method, providing users with a tangible and intuitive way to manage their finances.

Final Thought

With a whole lot of good budgeting apps available, choosing one is easier said than done. Each of them has its own strengths and weaknesses, and there is obviously no one-size-fits-all solution. So, the best budget app that will align with your financial journey will depend on your specific financial goals, preferences, and needs.

FAQ

What is a budget app, and how does it work?

It’s a software application designed to assist individuals and households in managing their finances. It provides tools and features to track income, monitor expenses, set financial goals, and create budgets.

What are the benefits of using a budget app?

Basically, it helps increase overall financial awareness for you to understand where your money is going, which is crucial for making informed financial decisions. Above that, it offers goal-setting, investment, and debt management capabilities to promote financial health and stability, leading to a better quality of life.

How do I choose the best budget app for my needs?

With a wealth of good budgeting apps around, you should focus on your current financial situation and your short-term and long-term goals and objectives. This will help you pinpoint the tool that best matches your needs and addresses your issues to the max.